Updated on January 21, 2025

Credit card marketing is used across BFSI industries to bring the financial tool to new customers. However, this market is currently facing a small crisis; according to Emarketer, the growth of new credit card accounts is expected to slow down through 2024-2027. This slowdown comes when credit card marketing is changing rapidly to meet new customer expectations and preferences.

However, credit card issuers will still be serving a broad consumer base. After all, over 175 million Americans own at least one credit card.

But more extensive consumer bases mean more competition. As of Feb 2024, 83 companies issue credit cards. Out of these 83, 10 companies issue 80% of all customer credit cards.

Your credit card marketing has to innovate and improve inside this marketplace to continue growth.

This is where a credit card marketing chatbot can help. Remember that the top 10 commercial banks use chatbots for product recommendations!

In this article, we’ll give you a no-code tutorial on how to make a chatbot that markets your credit cards. We’re going to cover:

- How Do Companies Market Credit Cards Today?

- New Strategies to Market Credit Cards

- Benefits of a Credit Card Marketing Chatbot

- Building a Credit Card Marketing Chatbot

- Drawbacks of Credit Card Marketing Chatbots

Let’s dive in!

How Do Companies Market Credit Cards Today?

Major players in the industry have been using multiple new techniques to capture the credit card spending market today. Some notable strategies include:

1. YouTube and Instagram Influencers – Chase collaborated with YouTube and Instagram influencers to host small promotional giveaways. This worked, and Chase got a lot of Gen Z and young millennial customers.

Influencers are an excellent way to get traction in the market because they have pre-built audiences to which you can market. Combine that with promotional giveaways, and you will soon have a growing user base.

2. Email Marketing – Since most major credit card issuers are also banking companies, they have a broad user base that they can upsell to. They do this through email marketing campaigns.

3. Content and SEO – “Best credit card” and “Credit Card rewards” are some of the most competitive keywords in Google. Companies often rely on well-planned SEO strategies to rank, ensuring their content aligns with user intent and delivers value.

4. Relationship Marketing – Relationship marketing is the oldest method of credit card marketing in the books. Here, a bank agent connects with you and tells you about the latest promotional offers.

5. Above-the-Line (ATL) Marketing – Another old technique where credit card companies sponsor specific events and provide premium access to credit card members. When leveraged well, this increases the number of applications considerably.

Alongside these tried-and-tested strategies, several new methods are also influencing the market. Let’s discuss them.

What New Strategies Can Companies Use to Market Credit Cards?

In 2023, 84% of Gen Z had already opened credit card accounts, cementing themselves as one of the primary growth drivers for credit card companies. But a new audience means new marketing strategies, and there are some innovations we’ve noticed:

1. Goodbye YouTube, Hello TikTok, and Instagram – More credit card issuers are turning to FinFluencers (Financial Influencers) on TikTok to advertise their products. Since these apps have huge Gen Z audiences, this has been a route for companies to approach them.

2. Chatbots and AI – Since social media has become a de-facto search engine for Gen Z, they also want quicker search options on a website. A chatbot for credit card marketing helps by providing them with personalized recommendations that they can apply to directly.

3. Celebrity Tour Sponsorships – Several brands collaborate with musical artists to produce tours. As a result, they can offer early access passes to their users, making it attractive to the Gen Z audience.

While sponsorships and influencer marketing can eat into your budget, AI chatbots are a quick way to enter and win over the Gen Z market. This gives you several benefits.

What are the Benefits of a Credit Card Marketing Chatbot?

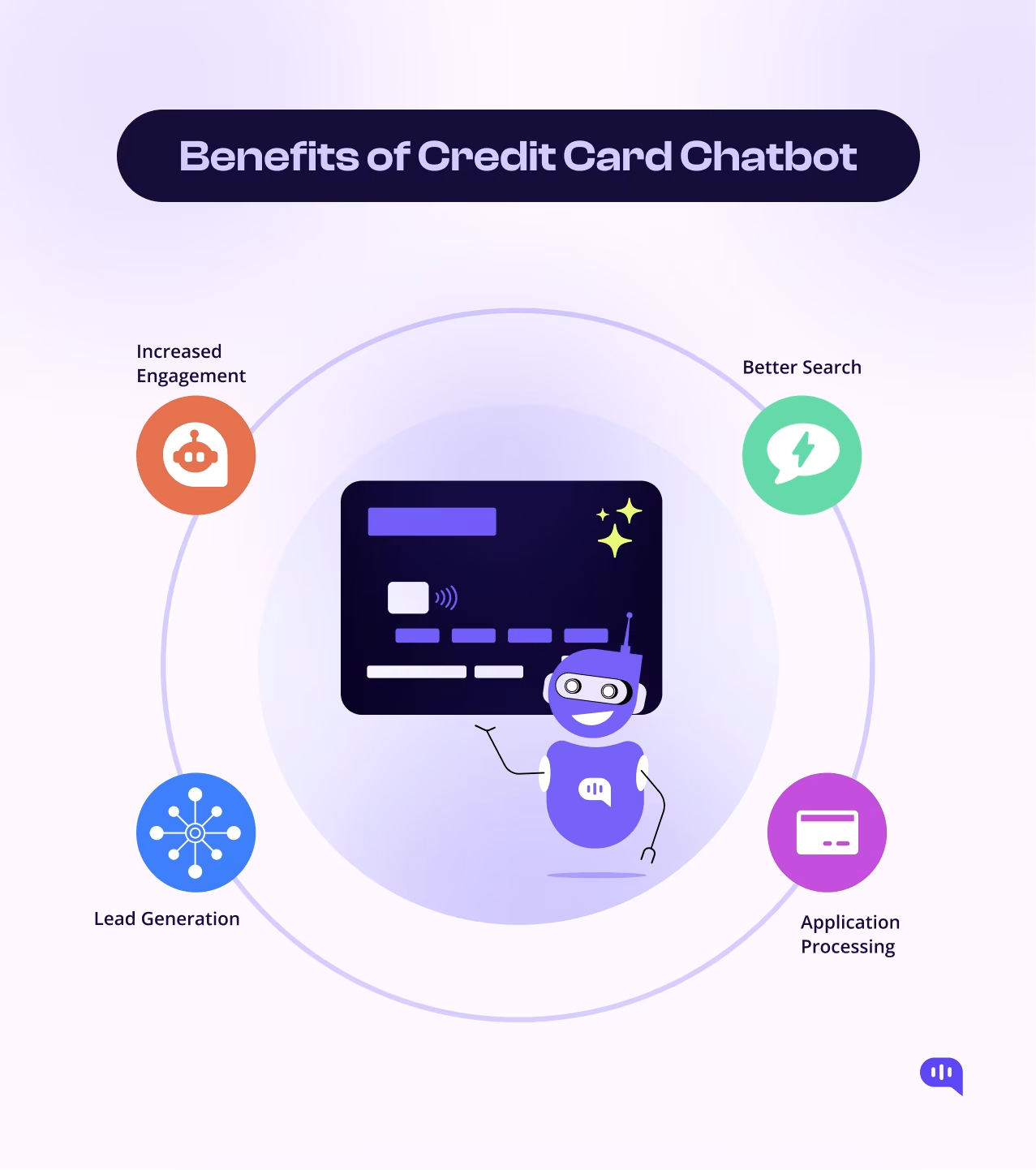

We’ve already discussed the benefits of chatbots at length in different articles. So, let’s focus on the specific benefits of the chatbots that you can use for credit card marketing:

1. Easier Search – People value convenience, and chatbots provide the easiest method of searching for personalized recommendations. AI can personalize and recommend products based on specific use cases.

2. Faster Application – Finding the correct application link and then going through the entire process creates multiple touchpoints. Chatbots can cut through this time and provide more rapid responses.

3. Lead Generation – If someone visits your website and doesn’t find a card that’s the right fit, you are left with no information. With chatbots, you can get their emails and names to connect with them for further upselling.

4. Higher Engagement – Gen Z and millennials prefer self-service channels. A chatbot provides a highly interactive self-service channel that engages users and helps increase conversion rates.

As you can understand, chatbots make the credit card search and selling process much more convenient. Increased engagement and lead generation give you more chances to market your products and services.

So, how do you build a credit card marketing chatbot? Let us give you a step-by-step process.

How to Build a Credit Card Marketing Chatbot?

We’re going to use Kommunicate to build this no-code credit card chatbot. You can start on this page if you aren’t signed up yet.

Let’s start:

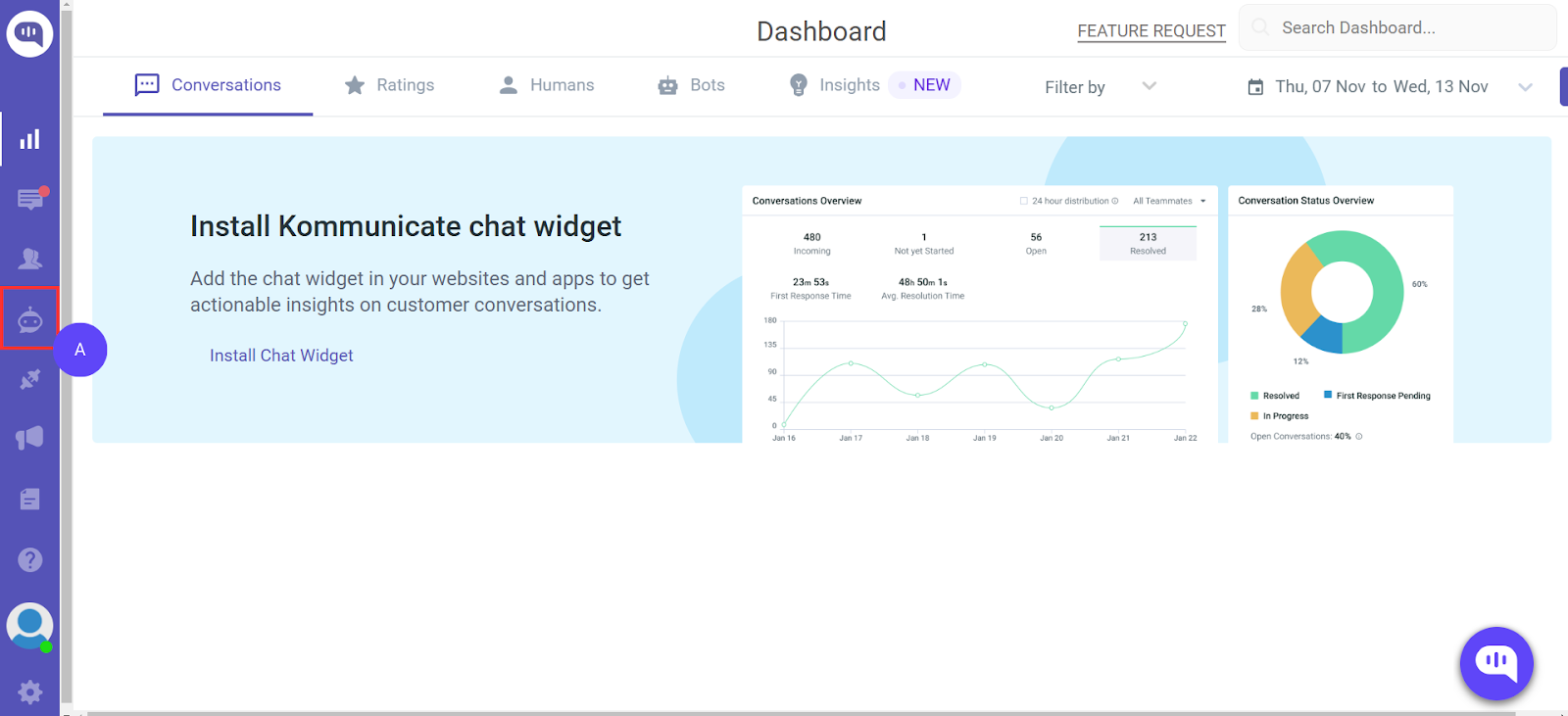

- Go to the Kommunicate Dashboard

- Visit dashboard.kommunicate.io

- Click on the Bot Icon on the left-hand side (A).

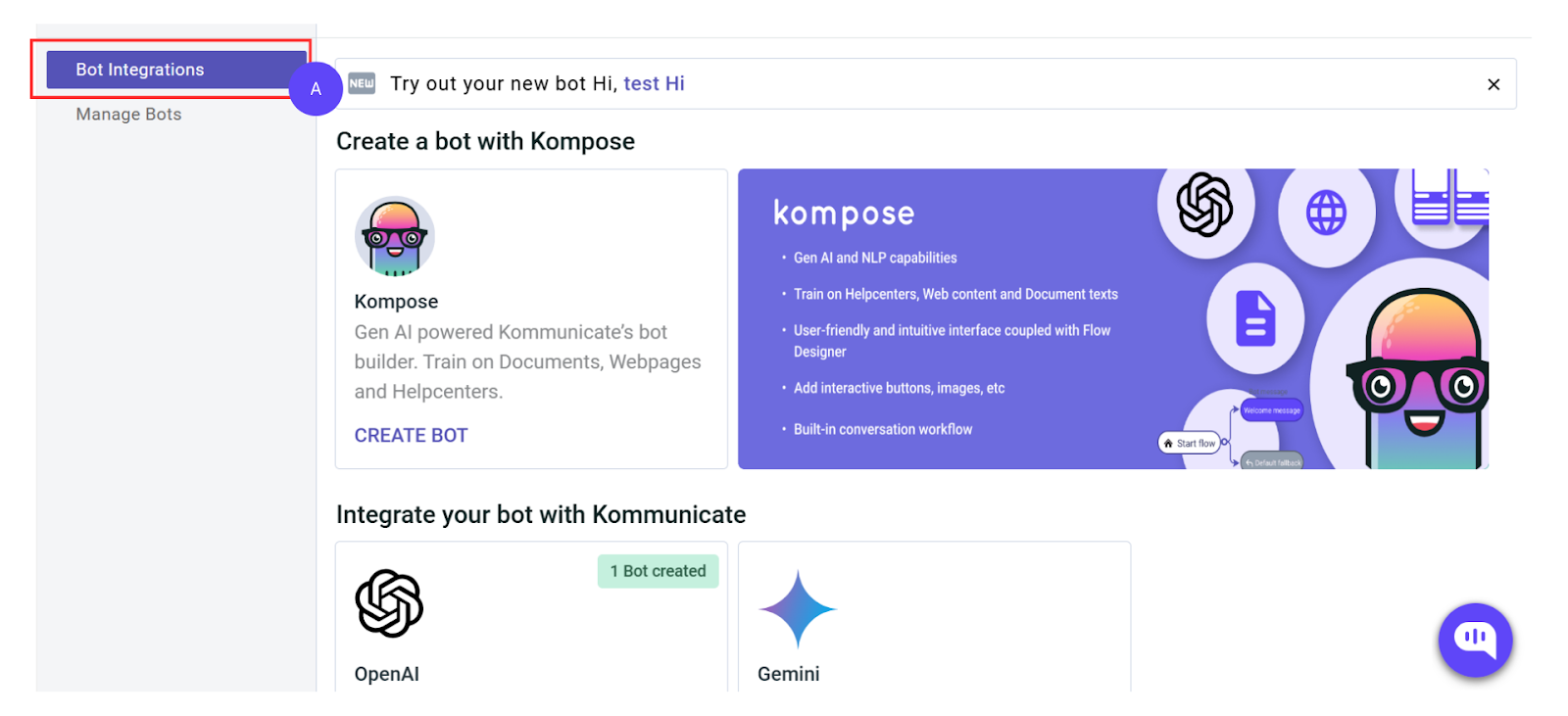

- Choose Bot Integrations

- If you create a chatbot with us, you’ll land on the Manage Bots page.

- In that case, click on the Bot Integrations tab in the left-hand menu, (A)

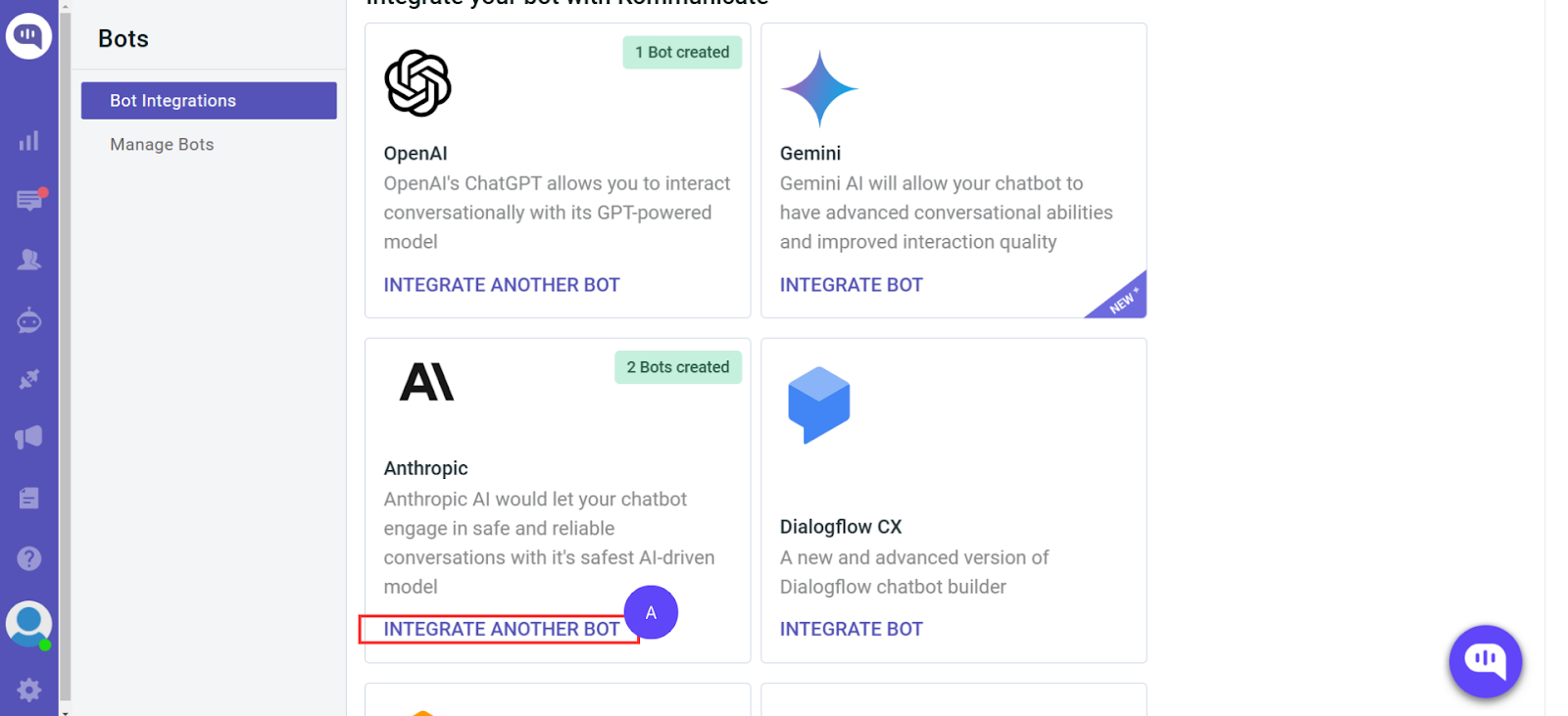

- Choose AI to Train Chatbot

- Choose the AI you want to train your chatbot with. We have Open AI, Gemini, and Anthropic models available.

- You can choose any model you like, but we’re selecting an Anthropic model and clicking on (A)

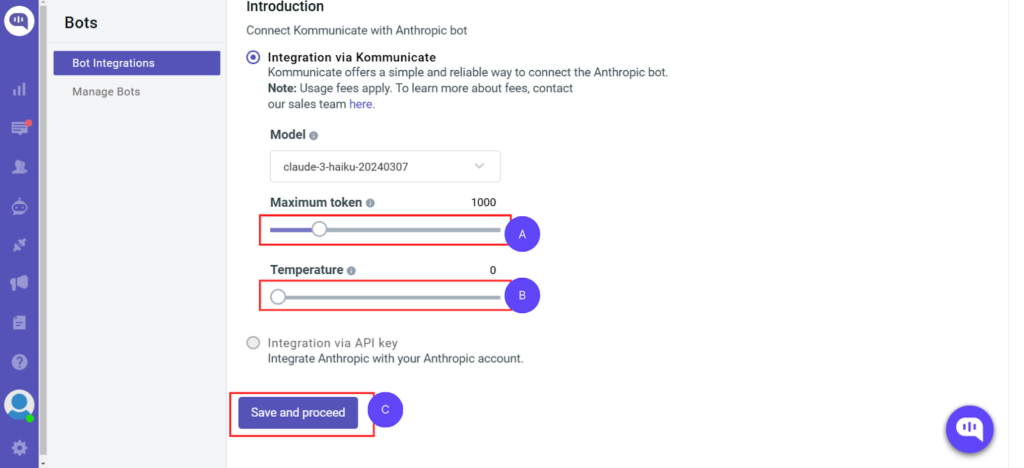

- Set Parameters for AI Model

- In the next screen, you can choose which large language model you want to train your chatbot. In Kommunicate, we have

- Anthropic’s Claude Haiku and Claude Sonnet models

- Google’s Gemini Flash and Gemma models

- Open AI’s ChatGPT 4-o, ChatGPT 4-o Mini, and ChatGPT 3.5-Turbo models

We recommend using a smaller model like ChatGPT 4-o Mini, Gemini Flash, or Claude Haiku so that your customers get fast responses.

- Now, select the Maximum Token (A). This helps you determine how long the AI’s answer can be. 1000 is a standard output number, so we are keeping this number unchanged.

If you’re working in an industry where the answers are information-dense, you can increase the number of tokens. However, you might incur additional AI costs. - Select the Temperature (B). This is a metric that controls the creativity of your AI chatbot. We will select 0 because we don’t want creative answers in a search and recommendation chatbot.

- Once you’ve selected your model, maximum tokens, and temperature, click Save and Proceed, and you will be taken to the next page.

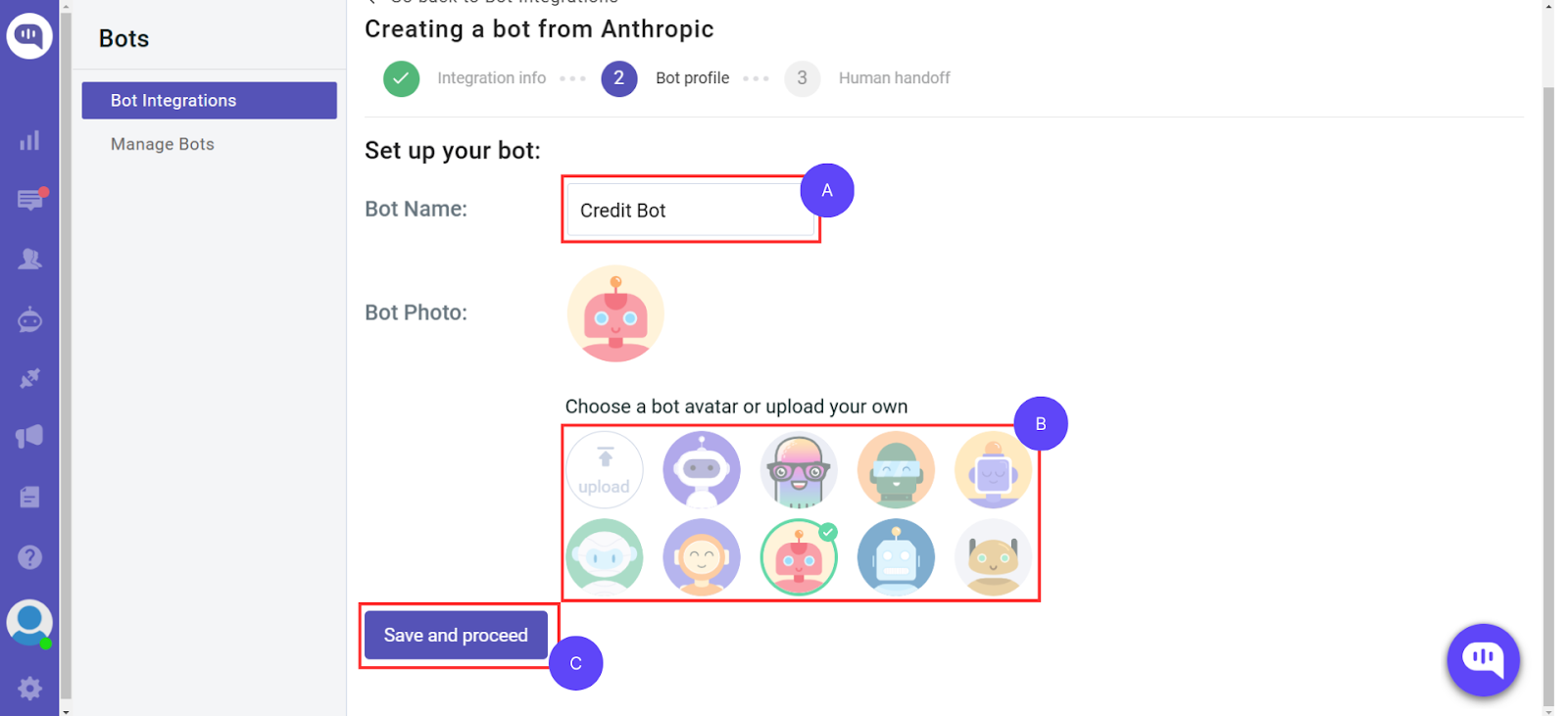

- Select How Your Chatbot Looks

- First, set a name for your chatbot (A). For this demo, we’re going to call it Credit Bot.

- Then, select the avatar that will be the profile picture of your chatbot (B). We’re choosing the pink avatar.

- Click on Save and Proceed (C ) to continue.

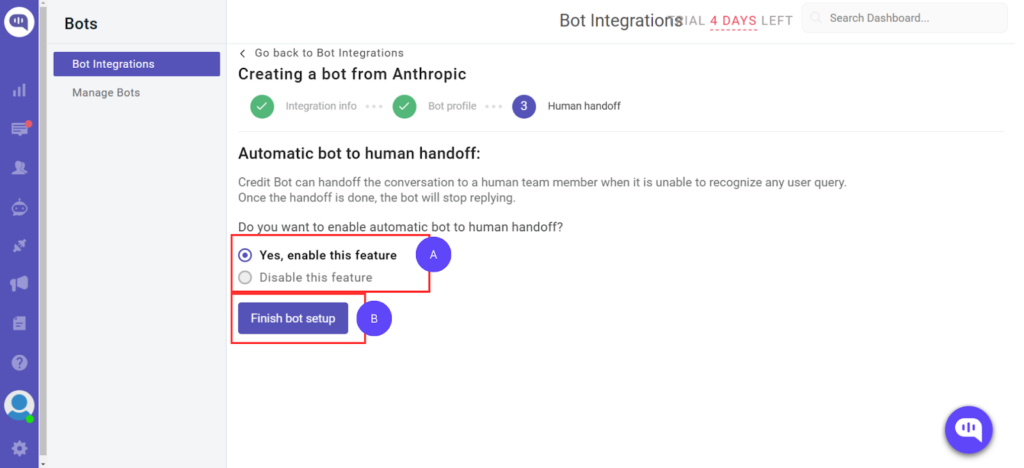

- Select if you Want a Human-in-the-Loop System.

- At Kommunicate, we have a Chatbot-to-Human Handoff feature that allows you to send a chat to a human when a chatbot can’t answer.

- It’s highly recommended that you click on “Yes, enable this feature” (A) to provide the best experience to your customers. You can set up Conversation Rules to see how these handoffs are handled.

- Once done, click “Finish bot setup”(B) and train your chatbot.

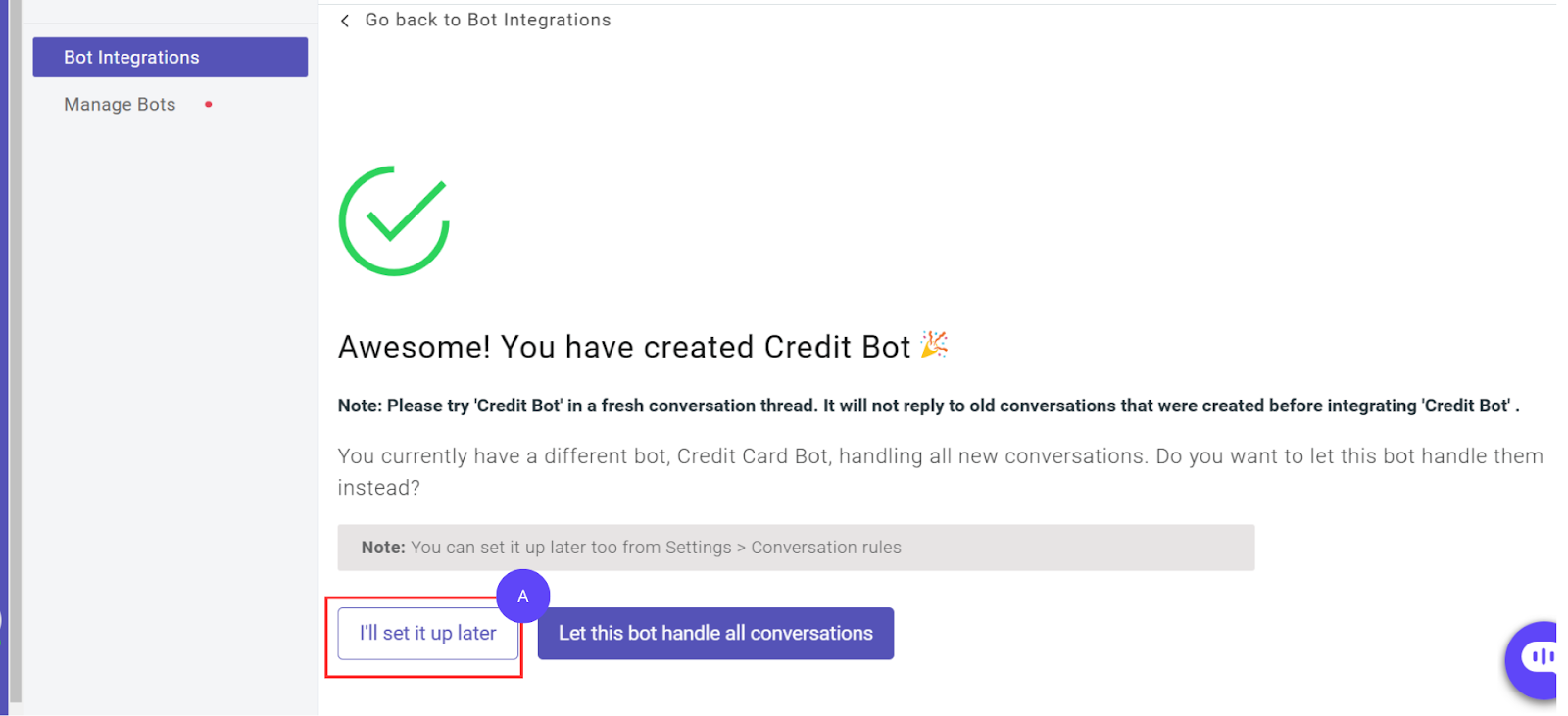

- You’ve Created Your Chatbot!

- Your chatbot has been created!

- Click on “I’ll set it up later” (A), and let’s start training your AI credit card marketing chatbot.

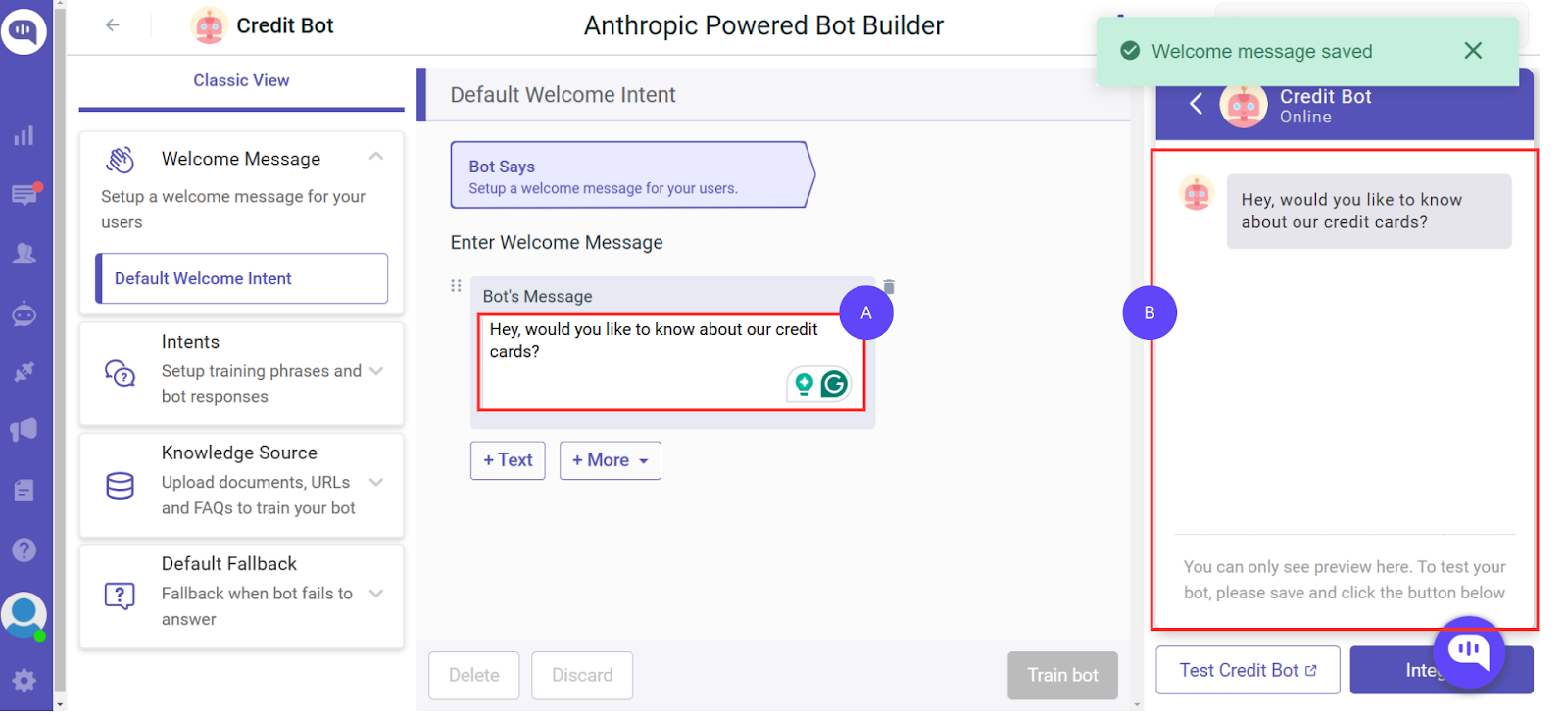

- Let’s Start Training with Welcome Intent

- We’ll start by setting up the Welcome Message.

- Set up your chatbot’s first message in the Bot’s Message section (A).

- You can see how it will look on the right-hand side (B)

- Click on Intents on the left-hand side for the next step

- Let’s Set Up Answers

- Your AI chatbot will learn how to answer questions by seeing your answers.

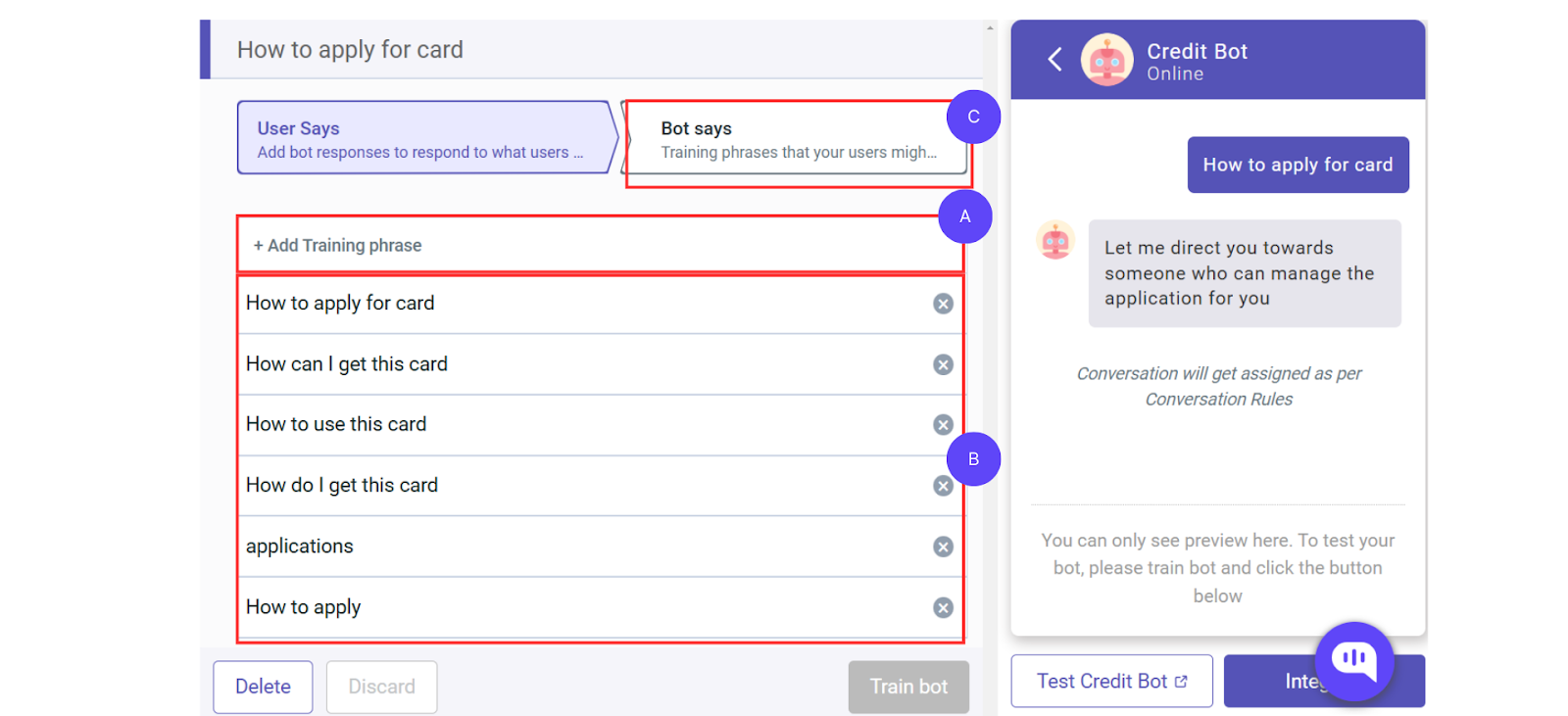

- Click on the Add Training Phrase space to train it for a new question. (A)

- We will train this chatbot to understand and answer questions about credit card applications. So, for this, we put in multiple training phrases that a customer might ask when they want to get to the application.

You can ask questions like “How do I apply?” “Application,” “Apply,” etc. (B) - Let’s show the chatbot how to answer the question by going to the Bot Says section (C ).

- Since credit card applications need you to submit multiple files and pictures, I will transfer them to an agent.

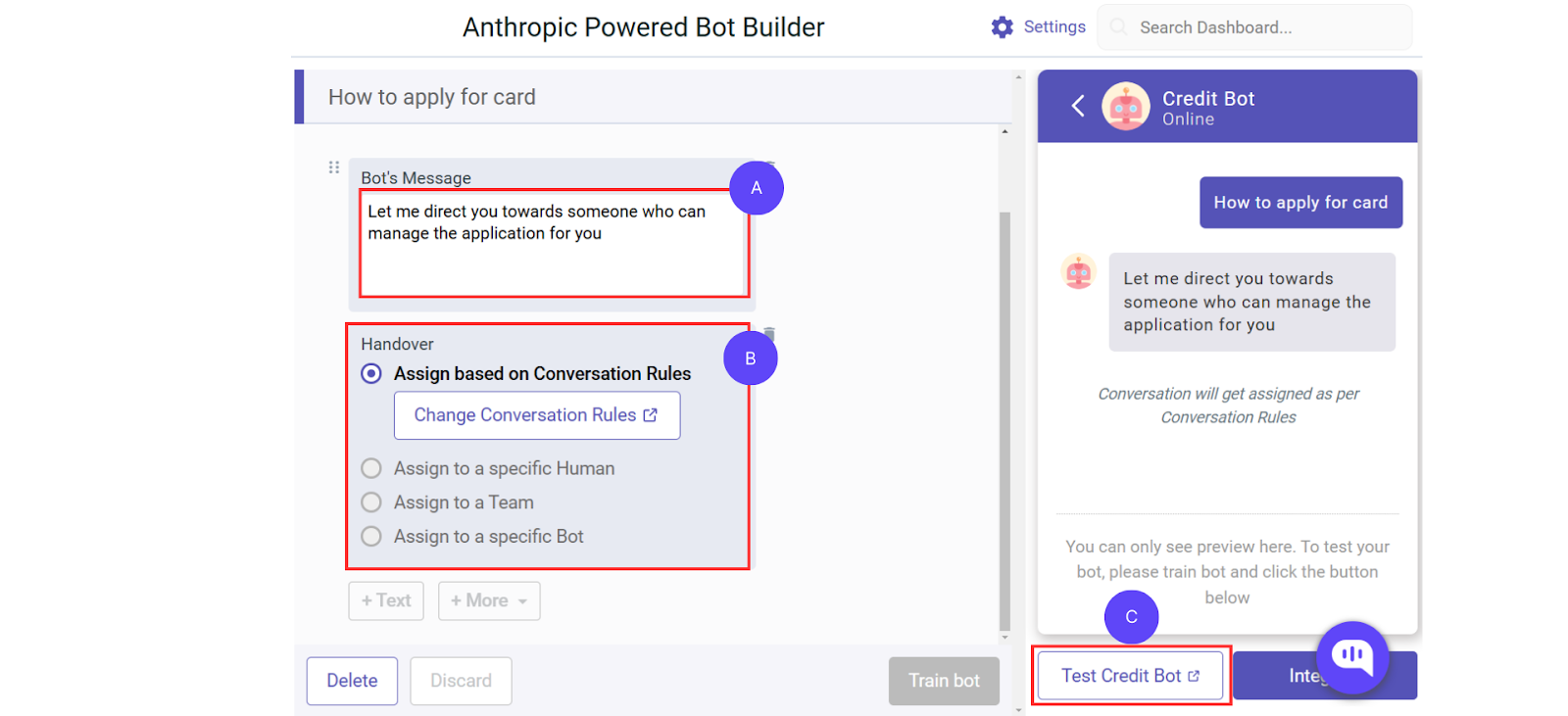

- First, we write a message in the Bot Says section that explains how the chatbot transfers the conversation (A).

- Then we click on +More and click on Assign based on Conversation Rules.

- Click on Train Bot at the bottom of the screen.

- Click on (C ) to test if the training has been done correctly.

Now, whenever someone asks our chatbot for a credit card application, they will be redirected to any available sales agent to finalize the procedure!

Set up as many intents as possible to cover more use cases for the chatbot. This will give your AI chatbot more information about how it should talk to your customers.

- Let’s Teach Our Bot About Credit Cards (Option 1 – URL)

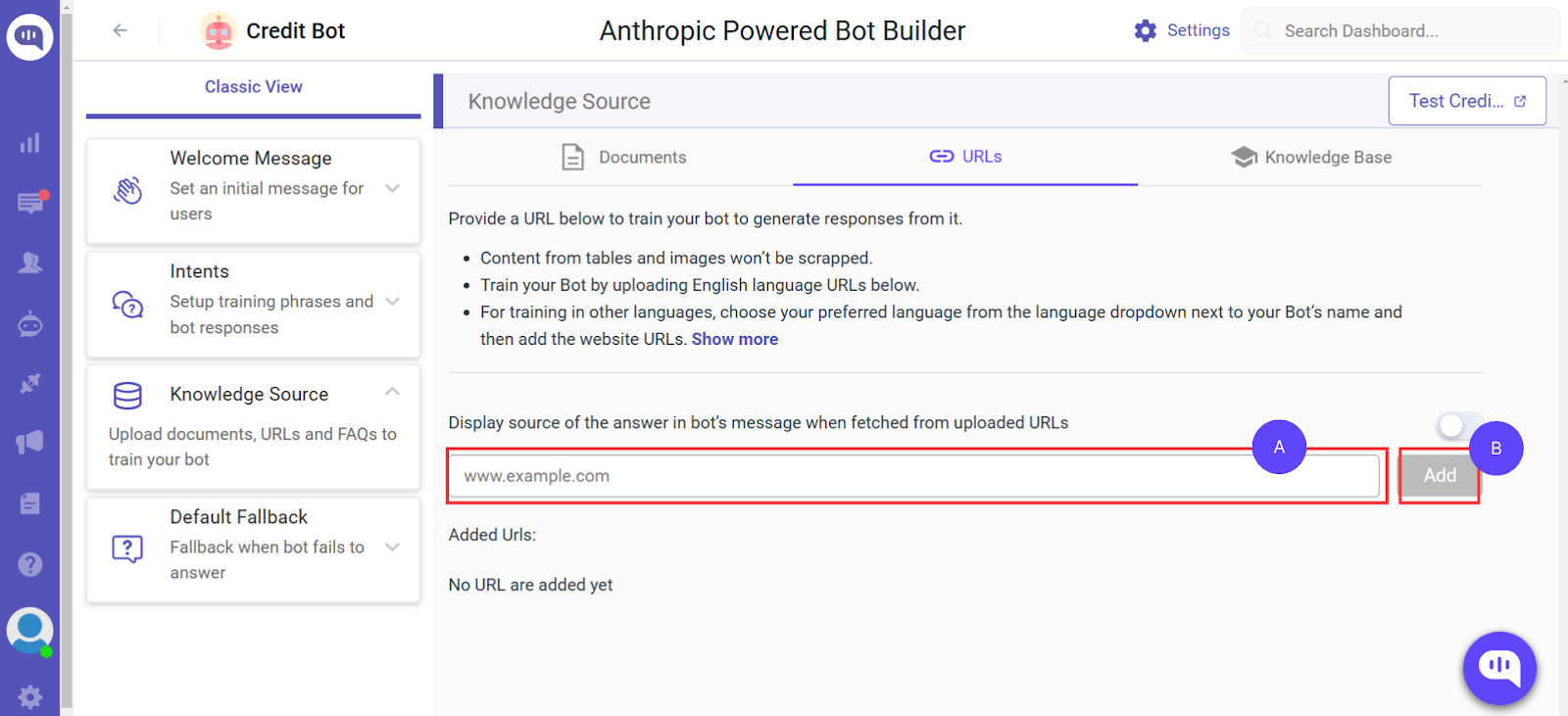

- If you want your chatbot to understand all the credit cards you have on offer automatically, you can navigate to the Knowledge Source page and click URLs at the top.

- Enter the URL to your company’s website with all credit card information (A).

- Then click on Add (B).

- This will open a window with your sitemap, and you can select the data you want to train the chatbot.

- You can also do this with PDFs and brochures.

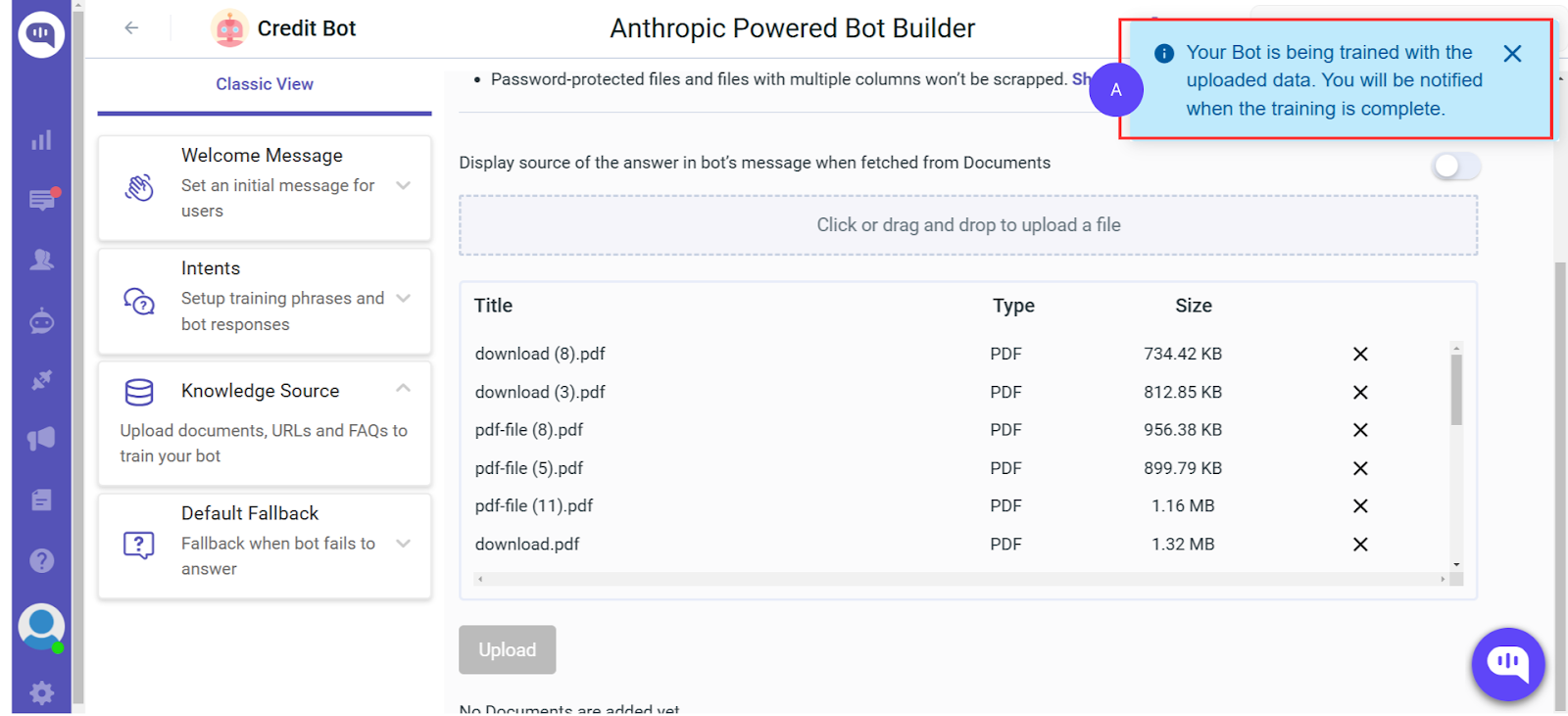

- Let’s Teach Our Bot About Credit Cards (Option 1 – PDFs)

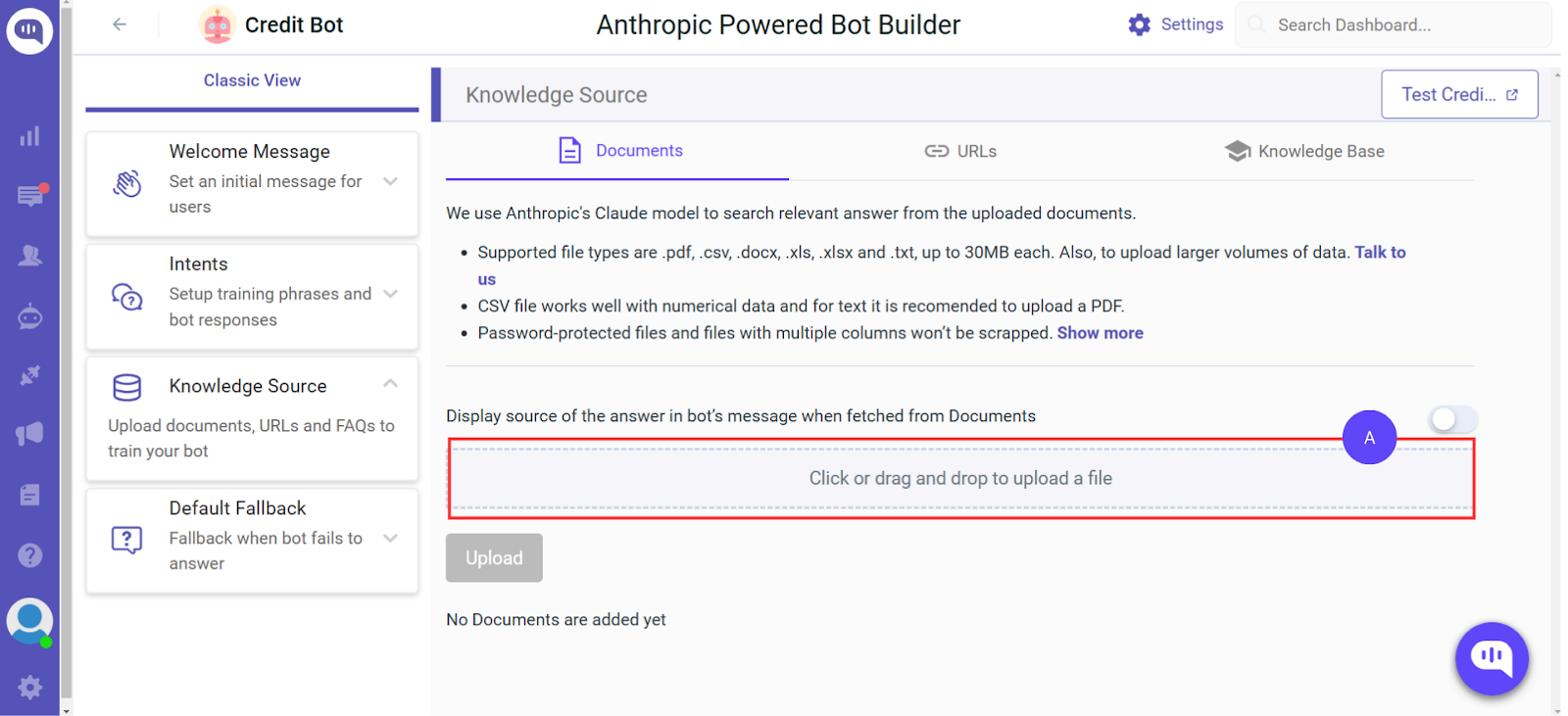

- We will use credit card brochures as the Knowledge Source for this tutorial.

- Go to the Documents tab and start uploading documents using button (A).

- Once you add all your documents, click on Upload.

- A pop-up will come on the top of the screen telling you that your documents have been accepted and will be used for training (A).

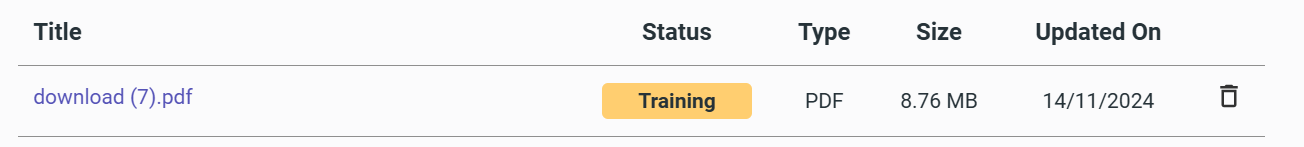

- When the AI is trained on a specific document, a yellow Training status will appear on your screen.

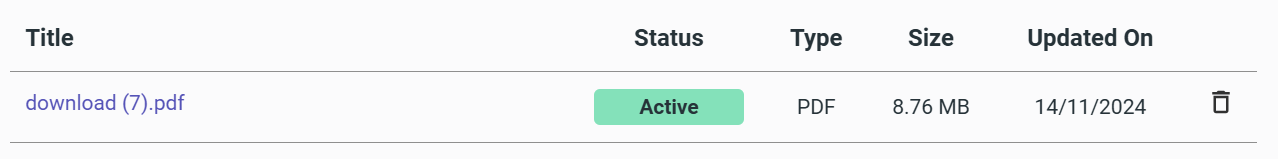

- Once the AI is set up with training, it will show as Active.

- Let’s Test the Chatbot

- Just like in Step 9, go back to Test the Bot.

- Ask the chatbot to recommend a credit card based on your use case, and it will answer!

The chatbot connects “train travel” with the IRCTC and SBI Collaboration Card!

However, a chatbot like this has a few drawbacks; let’s discuss that, too.

What are the Drawbacks of Credit Card Marketing Chatbots?

We have talked at length about the possible drawbacks of AI Chatbots. In this case, for the chatbot we trained, there are a few specific drawbacks:

1. It’s not emotionally intelligent – As you can see in the tutorial, you will need to teach the chatbot how to be friendly through various Intents. This adds a friendlier tone to your chatbot.

2. It might make Mistakes – While the chatbot will handle most credit card questions, it will still make mistakes. This is why we chose to include a human-in-the-loop system at Step 6.

3. You will need to Re-Train it Periodically – Since credit card terms and conditions change frequently, it’s recommended that you keep retraining the chatbot on updated websites and documents.

While your credit card marketing chatbot might suffer a few drawbacks, it will still provide your customers with personalized searches and recommendations for credit cards!

Conclusion

The credit card market is expanding rapidly, with new users (particularly Gen Z adults) searching for a new credit card.

Banking industry have continuously innovated over the past few years, trying to capture the Gen-Z attention. AI chatbots that recommend products are a strategy that has gained popularity in recent years. Most major credit card companies use chatbots to up-sell and cross-sell their products to customers.

You can copy this strategy by picking up an AI credit card marketing chatbot! We’ve given you a step-by-step tutorial on how to do it without any code involved.

Feel free to Book a Demo and build your credit card marketing chatbot with Kommunicate!

As the Head of Growth, Marketing & Sales, Yogesh is a dynamic and results-driven leader with over 10+ years of experience in strategic marketing, sales, and business development.