Updated on May 24, 2024

The traditional banking sector, as we know it, is at the cusp of a digital revolution.

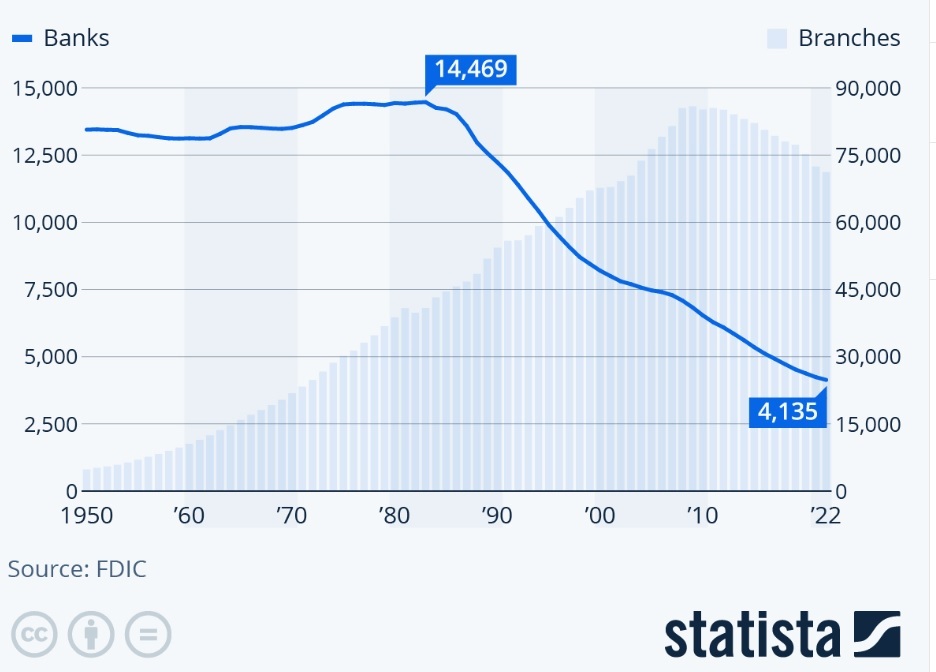

Forty years ago, in the 1980’s, there were 14,469 commercial banks in the United States. By the end of 2022, the number of banks was down to 4135, according to data from the FIDC. However, the number of bank branches increased from 40,000 in 1983 to 71190 at the end of 2022.

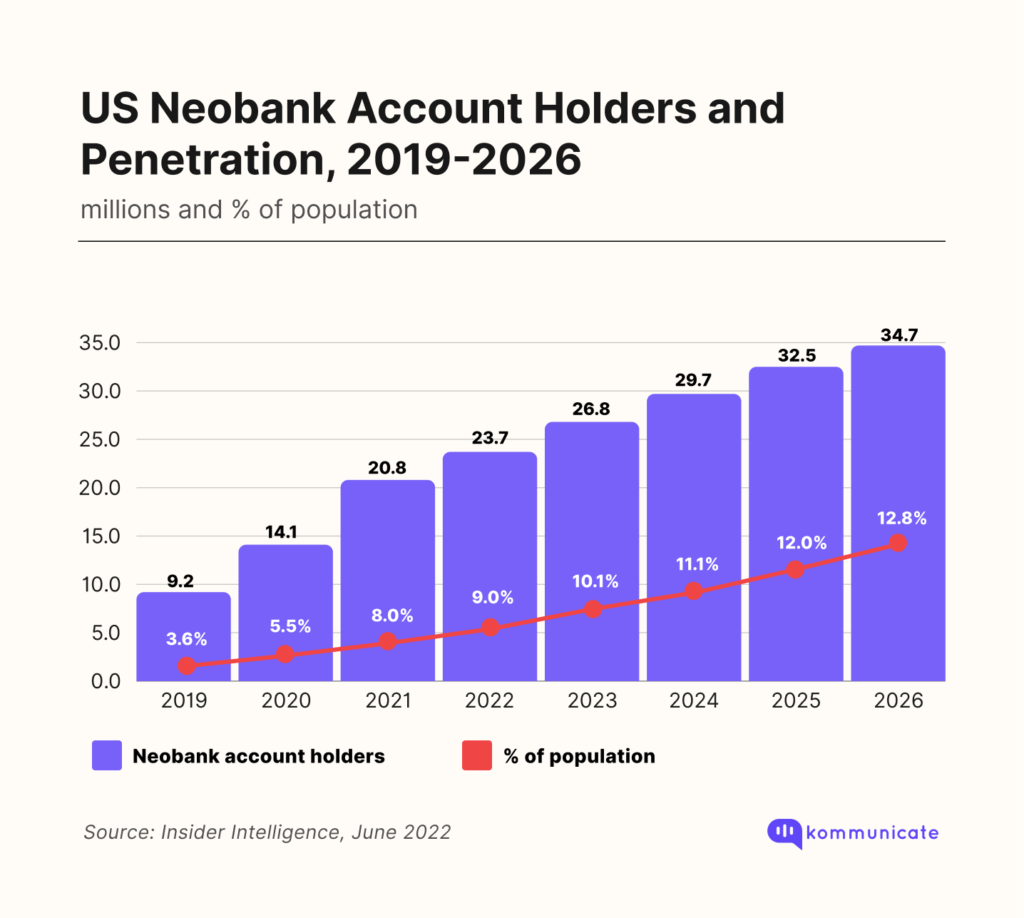

But you cannot stop the advancement of technology, and more and more customers are now turning to neo-banks that use fintech to offer cheaper, better, and faster financial services. The number of US Neobank account holders will grow by 46.4% from 2022 to 2026, according to this report from Insider Intelligence.

So, how are fintech companies attracting new customers in an era when traditional, well-established financial institutions are struggling? The answer lies in two words: Customer Service.

In this blog post, we are going to read about how Customer service in fintech is evolving by the day, and how technology is playing a major part in this evolution.

By the end of reading this blog post, you will know how fintech ensures superior customer service by:

- Omnichannel support

- Transparency and education

- Personalization through AI

- Self-service and Automation

Starting things off, let us see how offering omnichannel support is ensuring that customer service in fintech is top-notch:

Omnichannel support

Offering omnichannel support allows fintech companies to give customers increased accessibility, convenience, and all in all a unified experience. This fosters a sense of trust and loyalty in the customers, which is of utmost importance in an industry that relies on security and reliability.

Some of the biggest names in fintech, such as SoFi and Chime, allow customers to seamlessly switch between channels, such as mobile apps, websites, and chatbots. If you are using Chime and initiate a conversation over chat on the mobile app, you can continue the conversation via phone or email without repeating the issue.

SoFi also gives access to a virtual assistant that can escalate complex queries to a human agent. This type of omnichannel support ensures that customers get a consistent and uninterrupted experience, improving overall satisfaction.

Transparency and education

Simplifying complex financial concepts has been one vital component of redefining customer service in fintech. They do so by ensuring transparency and educating customers, which helps build customer engagement and long-term relationships.

According to Marketwatch research, only 53% of adult Americans are aware of financial planning, with 40% unaware of IRAs, money market accounts, and high-yield savings accounts. Financial services are complex in nature, so fintech firms today prioritize customer education through interactive tools and educational resources.

Take the case of Acorns, a micro-investing platform, for example. Acorns offers a detailed financial literacy program called “Money Matters,” which teaches readers about retirement planning, investing and budgeting.

As more and more fintech institutes prioritize education and transparency, they position themselves as trustworthy partners in managing personal finances.

Personalization through AI

Fintech companies are increasingly using artificial intelligence to deliver highly personalized customer service experiences. Using sophisticated machine learning algorithms, fintech institutes can analyze investment portfolios and provide tailored recommendations.

Ally Bank, for instance, is a digital banking platform that uses AI-driven chatbots and virtual assistants to give financial advice to customers based on their income, spending habits and financial goals.

The platform can tailor its support and guidance based on these individual parameters, giving way to a highly personalized customer experience.

Self-service and automation

More and more fintech companies are embracing self-service and automation, improving operational efficiency and giving customers more control and convenience. Well-built self-service platforms powered by AI and automation are helping customers get the best out of their fintech experience.

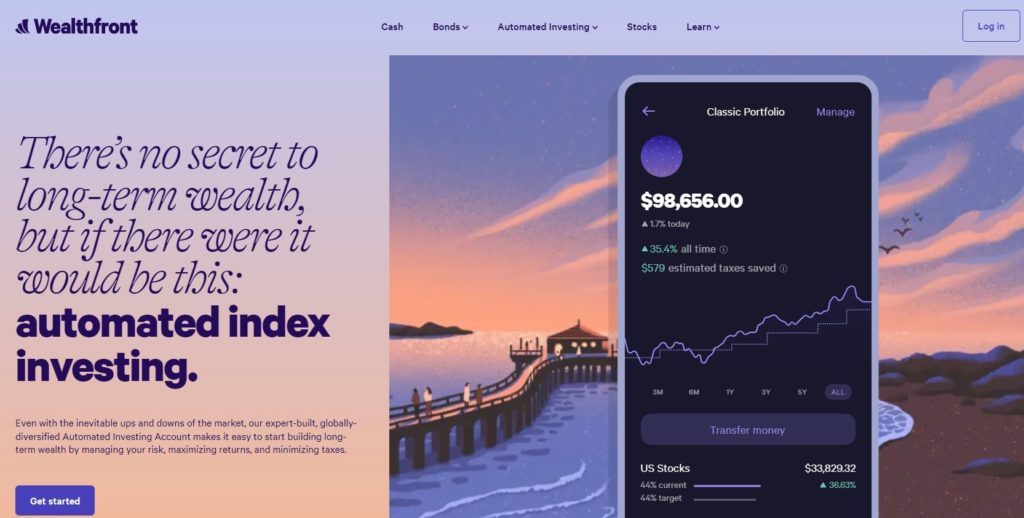

Wealthfront is a prominent investment advisor, and it offers a very comprehensive self-service portal in which customers can read educational resources, and portfolio analysis tools and use AI algorithms to get personalized investment advice.

Customers can thus manage their investments independently, while at the same time, receiving tailored guidance about their assets. This approach by companies like Wealthfront reduces wait times, improves accessibility, and makes customers feel that they are financially literate.

While fintech companies are upping the game by providing superior customer service, there are certain challenges that you should be aware of.

Here they are:

Challenges of providing superior customer service in the fintech space

- Managing large volumes: Fintech organizations generally gain traction quite fast, with some of them adopting marketing strategies that tend to go viral. Customer service teams thus should adapt to face a high volume of requests, complaints and inquiries. Making sure that the response is given in the least amount of time, and ensuring that each customer gets personalized assistance is thus a challenge.

- Complex product offerings: The very nature of fintech products is that they can be highly complex and technical. This means that customer service agents may not be able to grasp all the subtle nuances of the product, leading to a inaccurate guidance to customers. The way to solve this problem is to continuously train the customer service team and to create comprehensive knowledge bases.

- Treating sensitive financial data: Fintech institutes generally tend to deal with very sensitive personal and financial data, raising concerns over data security and privacy.Institutions should maintain customer trust by ensuring the highest level of data protection.

Data breach alone cost businesses worldwide an average of $4.45 million, an increase of 15.3% from 2020, according to this report.

Fintech institutes should also ensure that they adhere to strict compliance regulations.

- Fraud prevention: Customers of fintech organizations entrust these companies with their personal assets, sometimes their entire life savings. It is thus important for these fintech institutions to safeguard the customers’ assets, by implementing strict security measures and fraud prevention schemes. All this, while providing a frictionless customer experience, can be a challenge for the fintech institutes.

- Providing seamless experience across channels: Providing an omnichannel customer experience that is consistent across channels. This can be the website, mobile app, chatbots, or traditional channels like phone and email. Integrating all these channels and maintaining them effectively is a significant challenge.

Fintech institutes can proactively address these challenges and invest in technology and personnel, thereby fostering loyalty and sustainable growth.

Now that you are aware of the challenges let us see how customer service is going to evolve, with a sneak peek into the future of customer service in fintech.

Future of customer service in the fintech industry

The fintech industry will continue to evolve, and customer service, as we know it, will evolve with it. Companies will see the rise of hyper-personalization, and they will use cutting-edge technologies to deliver exceptional experiences and build lasting customer relationships.

Some of the ways customer service will evolve include:

- Conversational AI and Virtual Assistants: As time progresses, chatbots and virtual assistants will get more and more sophisticated. They will be able to handle complex financial queries with ease and also give human-like responses to most of the queries.

- Kommunicate, for example, lets you build AI-powered customer service chatbots that can be integrated with OpenAI to give human-like responses to a majority of incoming queries.

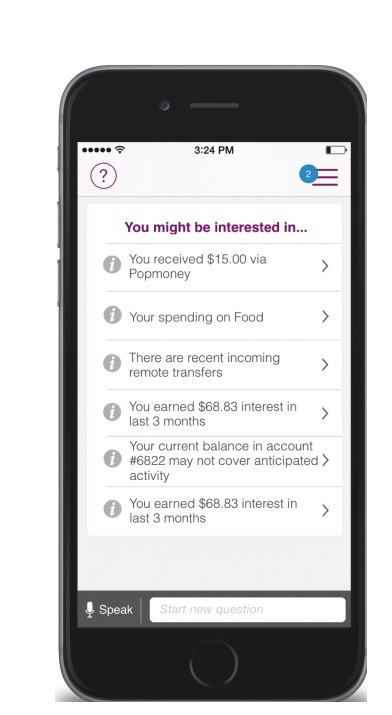

- Proactive support: Fintech companies will leverage data and predictive analytics, to anticipate what the customer actually needs and provides that support to them. This will reduce the need for reactive customer service interactions.

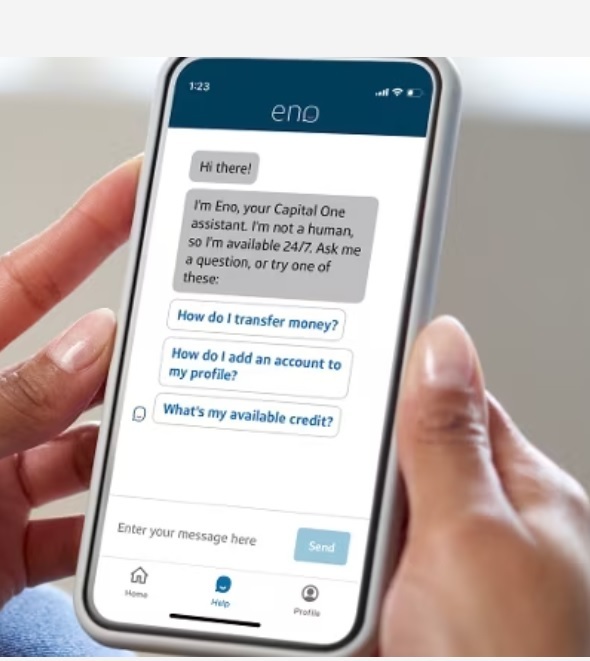

- Capital One’s virtual assistant, “Eno,” for example, uses predictive analytics to proactively give assistance to customers. Eno identifies potential issues by analyzing spending patterns, upcoming payments and account balances. Eno analyzes customer needs proactively and gives timely, personalized support.

- Hyper-personalization: Fintech companies have a lot of customer data with them, and they will use machine learning and advanced analytics to deliver a very personalized customer experience going forward. Interactions, recommendations and services will all be tailored to individual preferences and goals

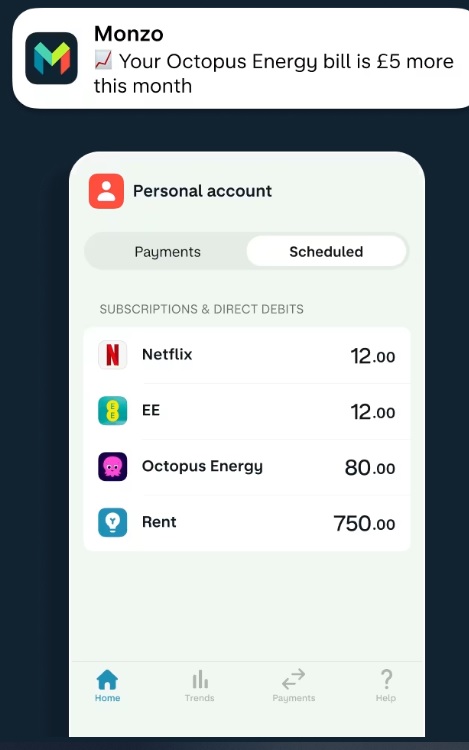

- A digital challenger bank called Monzo in the UK is known to give highly personalized customer service, using data analytics and machine learning to understand each customer’s financial behaviour. Monzo’s mobile app has an intelligent budgeting and spending analysis feature. If the app detects that a customer is frequently eating out, it may suggest setting a monthly budget for restaurant expenses.

The future of customer service in fintech is exciting as it becomes more and more seamless, proactive and personalized. Companies will leverage cutting-edge techhnologies and deliver exceptional experiences that will foster long-lasting relationships.

Parting words

As you can see, the fintech industry is leading from the front when it comes to revolutionizing customer service through a customer-centric approach and innovative technologies. Traditional financial institutions can learn a thing or two from these fintechs and adapt or risk becoming obsolete as customer expectations rise. So which one is it going to be? Chatbots, virtual assistants, generative AI, or an improved knowledge base? As long as the end result is serving your customers better than your competitors, the channels don’t matter. What matters is the willingness to bet on these emerging technologies and the determination to see them implemented.

CEO & Co-Founder of Kommunicate, with 15+ years of experience in building exceptional AI and chat-based products. Believes the future is human + bot working together and complementing each other.