Updated on February 20, 2025

Conversations with customers have become the need of the hour for businesses. Now we are witnessing a paradigm shift from mass-centred to granular, account-based approach in the context of banking automation and AI-powered banking solutions.

Banks and other financial institutions, who work closely with customers, and rely heavily on customer relationships, have always leveraged technology to assist them.

First, it was internet banking in the late 90s, then mobile banking when the smartphone revolution took over the world. Now, with the advent of AI and machine learning, conversational banking, powered by AI-powered banking solutions, is on the rise.

Conversational banking is nothing but communication between a bank and its customer through text, voice, or visual interface. It adds that extra touch of personalization in customer relationships.

Conversational banking, though highly effective, comes with the hardship of effective implementation given the sheer volume of customers banks serve (or any B2C business for that matter).

That is why AI becomes extremely important in conversational banking. With chatbots and virtual assistants, banks can serve their customers effectively without spending huge amounts of time, resources, and manpower.

In 2017, some of the major banks in the US released their banking chatbots and virtual assistants. According to a survey by Celent, 85% of the banks think that AI will have significant effects on banking. 32% of the banks have already started making direct investments in it.

Customer service is the most important aspect of delivering better customer experience for banks.

The US Banking Customer Experience Index, 2018 by Forrester

The reason why chatbots are deemed to the future of banking assistance is their capability to have personal, one-to-one conversations with customers. It gives the assurance of being taken care of to customers.

Let’s now briefly look at what chatbots are and how an ideal chatbot for banking is built.

Elements of Building Chatbots for Banking

Chatbots are nothing but software programs written to facilitate conversations. Hence, they are going to be as smart as you want them to be.

Your chatbot can be a simple button-based or advanced AI-powered contextual chatbot. The amount of sophistication you want to bring depends on the use case you are trying to solve.

A simple chatbot that tells your account balance, fetches your statement, or transfers money does not necessarily require AI. While on the other hand, a purely conversational chatbot is powered by AI and requires a lot of data to learn.

Irrespective of the type, you need to consider these elements to build a great chatbot for banks:

- Channels

- Chat interface and conversational UI

- Rich actionable messaging

- Security

- Natural Language Processing

- Fallback to humans

Let’s discuss these points in detail.

1. What Channels to Use?

Chatbots in banking can be deployed on one or multiple channels. The obvious ones are your websites and banking apps. These are the platforms where customers transact. They can also be deployed in instant messaging apps such as Facebook, Twitter, or Whatsapp, enhancing the reach of conversational banking solutions.

It largely depends on the support channels you use, the audience behaviour, and your use case.

Bank of America has deployed Erica, the financial digital assistant, on their mobile app. While Wells Fargo has used the Facebook Messenger bot to kick start their chatbots journey. Going a road a little different, Capital One has developed Eno, an SMS based chatbot.

The channels are not limited to textual conversations only. With the rise of Deep Learning, voice-based virtual assistants are on a rise. Probably we interact with voice-based chatbots on a daily basis. Google Assistant, Siri, Alexa, and Google Home to name a few. Few banks are leveraging voice cum text-based chatbots to widen the functionality.

2. Chat Interface and Conversational UI

One more reason chatbots are flouring in the banking industry is the ease of use. Instant messaging apps saw an exponential rise in the last decade.

The reason is – most human interactions are carried over short conversations. The ease of use and effort required in chatting is much lesser when compared to calling.

Hence, when you create a chatbot, make sure to keep the interface similar to that of messaging apps, often called conversational UI. Most people already have used some or other kind of messaging app. Hence the UI does not look alien and they can make an instant connection.

It also gives a feeling of personal touch and being taken care of. They mimic human to human interaction, which we have been actively using for the past decade at least.

You need not build the whole chat interface from scratch. The SaaS boom has put a plethora of options on the platter. There are solutions specifically made for customer support chat that you can integrate into your website/apps easily. Kommunicate comes with an option of directly integrating a chatbot into the customer support chat.

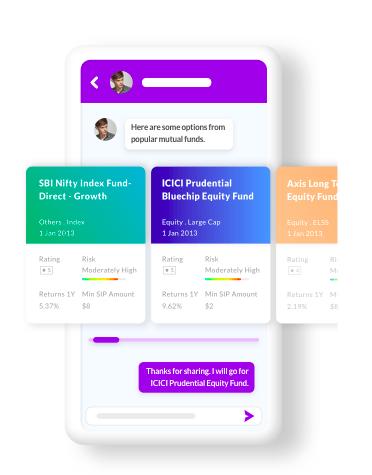

3. Rich Actionable Messaging

Rich actionable messaging makes the conversation interactive, fruitful, and easy to act upon. You can use buttons, lists, cards, and carousels. It helps speed up the whole process by providing visual, interactive, and beautiful elements in the chat itself.

Imagine the process where a customer needs to type all the things out and get answers to those queries. In place of this, rich messaging provides avenues for handling basic cases with the click of a button.

This makes it a win-win for both customers and banks alike. The sheer volume of customer queries received are solved faster and the customer’s need for instant gratification is satisfied.

4. Security

Data security is extremely important for banking operations due to the involvement of financial assets. Also, a customer will be more comfortable in using conversational banking services if they trust the services.

Trust comes from ensuring good security and authentication processes. You need to have an authentication layer(s) to identify the user and authenticate transactions.

5. Natural Language Processing (NLP)

NLP is a branch of AI concerned with the interactions between computers and human (natural) languages, in particular how to program computers to process and analyze large amounts of natural language data.

In simpler terms, NLP facilitates the chatbot to understand, process, and reply to user conversations.

Though all the chatbots do not necessarily require NLP (say button-based chatbots), but for delivering a better customer experience and keeping the conversation as human-like as it can be, NLP is a must.

As said earlier, the reason why chatbots are termed as the future of customer conversations is their ability to carry out a human-like conversation. The more you train your chatbot with relevant data, the better it would be.

You could either build your own NLP engine from scratch or choose from existing NLP platforms especially made for chatbots such as Rasa, Dialogflow, or IBM Watson.

Although, NLP is a relatively new and novice branch. There are multiple challenges associated with NLP. Most noticeably, the requirement of data and its inevitability to fail in certain conversations.

To give you a perspective, Capital One’s Eno understands over 2,200 terms and emojis people use to ask about their account balances. It may take more than a year to fully train and develop such a chatbot. Yet, in all their glory, chatbots are not humans and are deemed to fail at a certain point in time.

Even the leading AI researchers do not have a date or year in mind for chatbots that can carry on conversations in the same depth as that of humans. Hence, it is really important to handle such cases judiciously. What should be the ideal fallback in case the chatbot is not able to answer customer questions?

6. The Fallback to Humans

The whole point of leveraging chatbots in financial services is to provide a great, personalized customer experience without spending fortunes on time and resources. But chatbots may not be able to answer all customer queries.

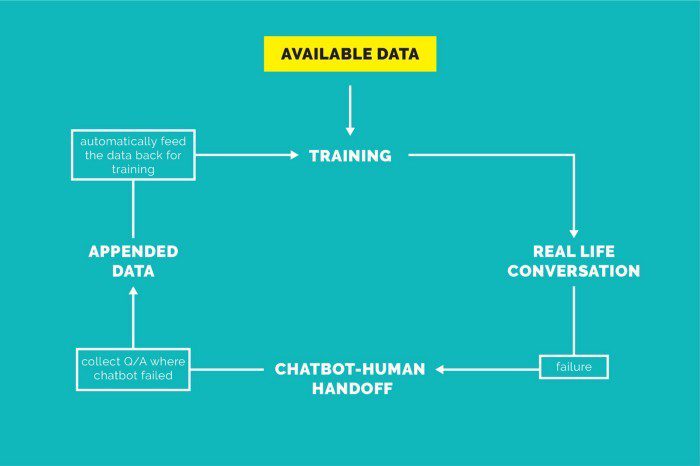

You should be able to handle these cases without breaking the customer experience. This is where chatbot to human handoff comes in handy. You can transfer the conversation on the basis of triggers that emphasize that the chatbot is unable to understand and answer.

To go a step above and improve your chatbots, you can store all these messages where the chatbot wasn’t able to answer customer queries. You can feed the same questions and answer back to the NLP system and train your bot.

This not only improves your chatbot, but also reduces cases of human interventions. Better the chatbot, happy the customer, merrier the banks.

Boost support efficiency and resolve queries faster with

AI-powered email ticketing from Kommunicate!Advantages & Disadvantages of Chatbots in Banking

Although chatbots and customer support automation are promising, they certainly are not flawless. Let’s jump into some important pros and cons of using chatbots in the banking and financial services industry.

Advantages of Using Chatbots in Banking Customer Service

- Chatbots are faster

- They tirelessly work round the clock and are available 24*7*365

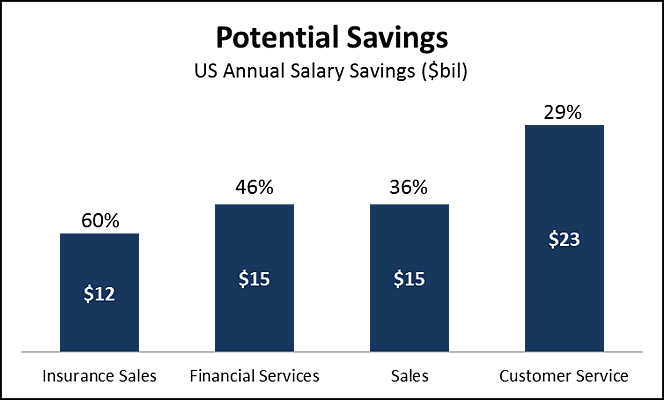

- Chatbots result in huge cost savings (see the graph below)

- Chatbots free up customer support reps time by solving basic queries, so they can concentrate on the complex ones

- They provide a personalized experience

The figure below suggests that we can achieve a potential savings of $23 billion in the U.S. alone using chatbots. Chatbots have the potential to automate 29% more of the tasks done by contact centre staff today.

Disadvantages of Using Chatbots in Banking Customer Service

- Chatbots are as smart as they are programmed to be

- Handling multiple languages and dialect can be a troublesome task for chatbots

- Gathering data, cleaning it and training the chatbot with it is a lengthy process

- Chatbot lack empathy, which is considered as the backbone of the business-customer relationship

- They are bound to fail. AI is a developing branch and a chatbot with human-level cognizance is probably decades away

- Reportedly, some chatbots have a low retention rate. About 40 percent of users never get past the first text, and another 25 percent drop off after the second message (Reported by BotAnalytics’ CEO).

The Best Bet Yet: Chatbot + Human Hybrid Solution

We have arrived at a point where life without technology will be impossible to imagine let alone running a bank. We need machines to assist us and do the dirty work while we work on complex and strategic tasks.

Machines are faster, efficient, do not tire out and can essentially work 24*7*365. But they are not smart enough, lack emotion, empathy, and human-level cognizance.

Whilst we humans may be rich in all the cognitive and emotional elements, we certainly have physical limits.

The question arrives whether chatbots are the way to go forward or customer service needs a human touch always. The customer service industry stands divided into these two aspects. Many people prefer chatbots for offloading work and many others think customer service is fundamentally an emotion-driven process and must require human attention.

But we need to understand that this is not a race. In the near future, the best possible solution is to harvest the good from both humans and chatbots. The speed and eternal availability of machines, empathy, and the cognizance of humans is the way forward. Here’s why:

1. Leverage speed, agility and 24*7 availability of chatbots

Banks receive numerous queries in a day, most of them are basic. Such as asking for balance in their account, looking for loan-related documents, how to send money to their peers, and similar activities.

You can train a chatbot to understand these basic intents and provide an appropriate response. Generally, all these queries are simple FAQs and redirection links. Hence a chatbot will save you time and resources which you can deploy to solve more complex queries.

2. Leaving the complex tasks for humans

When the chatbot is unable to understand the customer query, then you can bring your customer support agents to tackle the situation. The chatbot may fail to answer because of numerous reasons. Mainly:

- Customer may ask a question for which the chatbot hasn’t been trained

- The language or dialect uses is incomprehensible to the chatbot

- The query is complex

- Or the customer wants to talk to a human

In such cases, you can leverage chatbot to human handoff and bring a human to take over the conversation. Ultimately, solving customer queries is the goal, be it simple or complex.

3. Re-learning and improving

Given that chatbots cannot always have answers to customer queries, how do you make sure that the chatbot keeps learning? How do you make sure that the chatbot does not fail at the same question again and again?

The answer lies in feeding the important data from the customer conversation itself. Banks serve a wide variety of customers and from re-looking into the conversation, the chatbot can learn consumer behaviour over time.

Also, it is of utmost importance that you build processes to automate the learning from the conversation between customer support agents and customers. You need to feed in the queries, questions, and triggers where chatbots failed to answer. In this way, the chatbot keeps learning new dialects, behaviour, and questions. This helps further reduce the load on humans.

This is what we call a chatbot and human hybrid customer support system. As said before, this coalition between humans and AI is the way forward in customer support.

Pain Points in the Banking Industry that Chatbots Can Solve:

The Banking industry is one rife with issues that chatbots can solve, and here are 5 of them:

- Long wait for customer support:

Customers usually have to wait for extended periods of time before they get assistance from customer support agents. In fact, a study by Econsultancy states that 83% of customers need some form of assistance while making an online purchase. These queries also require a lot of patience, and are best solved by chatbots, who can provide immediate assistance.

- Account information

One of the chief reasons people visit a bank is to check their account balance and transaction history. Chatbots can be instrumental in reducing the waiting times here, and customers will no longer have to visit a physical bank to access their account related information.

- Transaction inquiries and disputes

Resolution of transaction disputes is usually a time-consuming and frustrating process. Chatbots can assist customers in transaction-related issues efficiently. In fact, a study from PwC found that 27% of banking customers feel dispute resolution as a chief factor influencing their loyalty.

- 24/7 Customer support:

Customers today expect banks to be available to them 24/7, and with customer support agents, this is only possible if you hire more and make them work in shifts. In case you cannot afford to hire more agents, customers will be left without support. This is where chatbots can step in. Chatbots will be ready to support your customers round the clock, keeping your business open 24/7.

- Fraud detection

No customer likes fraudulent transactions on their bank accounts. AI powered chatbots can help detect suspicious transactions, enhancing security measures and boosting customer confidence. The fraud market in the US is big, and a Javelin Strategy and Research study found that in 2020, there was a loss of $5.1 billion in 2020.

Use Cases of Banking Chatbots

Banks are using chatbots for multiple purposes. Wherever there is a need for conversations or information, chatbots can pitch in.

Customer Support

Chatbots have flourished in the customer support space. Their ability to efficiently solve basic customer queries (which constitutes 80% of all customer queries) faster and efficiently makes them inherently important for customer support.

Lead Generation

Chatbots can act as an additional channel for generating leads for banking products. If a user is looking for opening a savings account with good interest rates, the chatbot can provide initial details and collect contact information. The contact information can then be passed on to the sales team for further follow-up.

Information Delivery

Chatbots can help deliver certain information to your customers. These are just like FAQs delivered over chat by a chatbot. Customers can search for the nearest ATMs, how to open a new account, the procedure to get a credit card, etc.

Account Operations

Customers can do basic account operations with chatbots such as checking account balance, getting statements, setting up a new account, paying bills, authenticating transactions, etc.

Back-Office Tasks

Another interesting use case of chatbots is to help in back-office tasks. JP Morgan Chase’s COIN helps the team to read and analyze complex contract documents easily. It is more accurate and faster than human lawyers.

Internal Support and Training

A lot of banks are using chatbots to handle internal documentation, IT support, cross-team information exchange, etc. Also, chatbots are being used to onboard new customer support reps and provide initial training and support to them.

Recommendations and Upselling

Chatbots are data mines. This facilitates so many customer conversations gathering a copious amount of data. These conversations can tell you about customer behaviour and provide avenues to make new product recommendations or upsell the existing services.

Certainly, there are more use cases of chatbots in the banking and financial services industry. The aforementioned use cases have been tested and applied practically by numerous banks throughout the world.

Real-Life Examples of Banking Chatbots and Financial Services

2017 witnessed the rise of AI in banking with many big names adopting chatbots. Chatbots are not only becoming popular in the US but also are becoming the centre of attraction across European, Asian and Australian banks.

Chatbots in US Banks and Financial Institutions

Nearly every major bank in the world is planning to leverage chatbots nowadays. Notably:

Bank of America

Bank of America is one of the pioneer banks in technology and the inclusion of AI in banks. They have released Erica, their virtual financial assistant. Erica can help customers check their account summaries, lock/unlock cards. Keep up with your e-bills, etc. It takes both text and voice as inputs.

Wells Fargo

Wells Fargo became the first US bank to provide a Facebook Messenger chatbot. The chatbot, Wells Fargo Banking Assistant has a goal to deliver information ‘at the moment’ and provide the ‘Aha! moment’ to customers. The chatbot currently responds to basic questions about deposit and credit card accounts, transactions, and branch or ATM locations.

Capital One

Capital One’s Eno is a text-based chatbot that is trained meticulously to accommodate all their audience. Eno helps customers detect frauds, monitor charges, track expenditures, and answer basic FAQs.

J.P. Morgan Chase

J.P. Morgan Chase is using chatbots for a different purpose. They are streamlining their back-office operations using a chatbot. COIN, their virtual assistant helps employees review the complex loan agreement documents in seconds. It is less error-prone than humans. Reportedly, it saves 360,000 manhours each year.

USA

USAA has partnered with a machine learning company to build a text and voice-based, natural language chatbot. The chatbot relies heavily on customer conversation and learns with every query coming in.

SEB Sweden

SEB Sweden has released Amelia, a virtual assistant which learns from customer conversations. “Our belief that this technology can create positive customer experiences is based on the good results we have seen in tests in IT support. During the first three weeks, over 4,000 conversations were held with 700 employees, and Amelia solved the majority of issues without delay,” says Rasmus Järborg, SEB’s Chief Strategy Officer.

Santander UK

Santander UK is the first bank in the UK to provide voice-assisted banking. Customers can just ask the chatbot to make payments, report lost cards, and check account statements, and bills.

Commonwealth Bank

Commonwealth Bank’s Ceba is trained to assist customers in more than 200 banking tasks. Ceba can recognize approximately 60,000 different ways customers ask for the 200 banking tasks (such as activating their card, checking account balance, making payments, or getting cardless cash) and will eventually be able to tell customers what they are spending their money on.

HDFC Bank

HDFC Bank has released India’s first AI banking chatbot, Eva. Powered by natural language processing, Eva has already answered more than 5 million queries from around a million customers with more than 85% accuracy. Eva holds more than 20,000 conversations every day with customers from all over the world.

Hang Seng Bank

Hang Seng Bank, Hong Kong has developed two chatbots HARO and DORI. While HARO (Helpful, Attentive, Responsive, Omni) answers customer queries about their account, cards, loans, mortgage, and other products. It also simplifies application processes for new products. DORI (Dining, Offers, Rewards, Interactive) provides customers with various merchant offers on dining and lifestyle. It can also make reservations at restaurants.

In addition to this, other banks such as American Express, Ally Bank, Mastercard, HSBC, RBS, and SBI have also made significant advances in using chatbots.

How to Build Chatbots for Banks?

You can build a chatbot from scratch, setting up your NLP from the ground up. Or you can use any third-party bot services to help you build the chatbot.

Dialogflow is one such service. You can refer to this guide to build a Dialogflow chatbot for banks. Note that, always keep in mind the basic elements of building the chatbot.

Do remember the basic elements of building an efficient banking chatbot (channels, chat interface, conversational UI, rich actionable messaging, security, NLP, and the fallback mechanism)

Notably, you also need a chat interface to let your users conversate with the chatbot. Here the instructions to help you deploy your chatbot in websites and apps (channels) with a built-in chatbot to human handoff (the fallback mechanism):

1. Integrate chatbots in the website.

2. Integrate chatbots in iOS and Android apps.

The Future of Chatbots in the BFSI Industry

As Gartner predicted, 80% of customer conversation will be driven by chatbots. This number may sound staggering to you, but even today you may be having more conversations with chatbots than you imagine.

How often do you use the likes of Siri and Google Assistant? They essentially are nothing but voice-based chatbots.

By 2020, the average person will have more conversations with bots than with their spouse. With the rise of Artificial Intelligence (AI) and conversational user interfaces, we are increasingly likely to interact with a bot (and not know it) than ever before.

Gartner

AI will make progress in banking and financial services, given the successful pilots of initial AI projects. Predictive analytics will help in making sense of the humongous amount of data banks receive. Trading and investments will have more avenues for predictability when tireless machines process the data intelligently. Some banks have already started leveraging AI for compliance management, fraud, and money laundering detection.

But most importantly, chatbots are going to get smarter. With significant advances in AI and Machine Learning, chatbots will get better and better. Though we can not predict the day for the chatbots to be super-intelligent, we can definitely tout an impeccable human+chatbot partnership for the way forward in the near future.

Subscribe here to get the good stuff — we solemnly swear to deliver top of the line, out of box and super beneficial content to you once a week.

At Kommunicate, we are envisioning a world-beating customer support solution to empower the new era of customer support. We would love to have you on board to have a first-hand experience of Kommunicate. You can signup here and start delighting your customers right away.