Updated on June 10, 2025

Step into a bank today, and the experience is nothing like it was a decade ago. There are no longer long queues or tedious paperwork. Nowadays, people want financial services that improve their online buying experience without first asking about their needs.

That’s where personalization comes in. As Steve Jobs famously said,

“You’ve got to start with the customer experience and work back toward the technology, not the other way around.”

With 72% of banking experts prioritizing customer experience, personalization is now essential, not optional. Unquestionably, banks that maximize tailored services can generate large income growth; estimations indicate a $300 million rise for every $100 billion in assets.

Now, the question is not whether banks should personalize but how well they can use AI-powered tools to make more money and keep customers interested. Let us look at how chatbots are being used to personalizing financial services.

What is Personalization in Financial Services?

Personalization in financial services means making banking feel tailored—like it was designed just for you. Financial institutions now provide specialized banking solutions that exceed standard banking models.

Modern customers want financial institutions to function like popular streaming and e-commerce platforms. They want them to deliver targeted solutions, anticipate their needs, and simplify their monetary choices. Personalization in banking builds financial partnerships by reducing transactions into human relationships.

Types of Personalization in Financial Services

When financial institutions develop practices that recognize each customer as distinct, they achieve personalization in their services. Through advanced data analytics, artificial intelligence, and automation, banks establish customer need predictions and provide consultants with quick advice, which helps them build lasting relationships with their users.

Here’s how personalization is evolving:

1. Prescriptive Personalization

Hundreds of data points from customer financial activities and transaction histories enter predictive analytics engines, which generate future need predictions for prescriptive personalization applications. By using this strategy, financial institutions can recommend suitable products and provide individualized financial advice and bespoke services to clients.

2. Real-Time Personalization

Financial institutions can maintain a personal connection with their customers by making instant adjustments that enable relevant and context-based services through real-time personalization.

Ride-sharing application Lula shows how artificial intelligence can drive personalization through its operation. Implementing Kommunicate’s AI chatbot resulted in a 40% increase in customer satisfaction (CSAT) ratings for the company. AI-powered real-time support has been proven to improve financial service engagement levels between users and their providers.

3. Machine Learning-Based Personalization

Machine learning technologies process extensive datasets to discover exclusive shopping behaviors of individual customers. The continuous analysis of customer behavior patterns powers AI-based models to develop better chatbot for financial services through improved recommendation systems and product offering optimization. Using data-driven methods allows personalization to adapt to evolving customer demands, resulting in improved banking processes.

Common Misconceptions About Personalization in Banking

Typical banking customers frequently fail to understand personalization; therefore, various misconceptions or AI chatbot fears prevent proper implementation of the approach. Several widespread false beliefs about personalization in banking require clarification.

Myth #1: Personalization Requires Vast Amounts of Data

Many individuals believe that personalization requires extensive data collection for financial institutions to succeed in this practice. Not true. The data banks obtain from direct customer sharing suffices to achieve personalization goals. Understanding and maximizing data effectiveness represents a bigger difficulty than collecting information does. Many banks already have the needed data but struggle to connect the dots.

Myth #2: Personalization is the Same as Segmentation

Customers should be grouped through segmentation according to their common characteristics. Personalization? That’s a whole different level. Through AI and machine learning techniques, banks successfully deliver individualized experiences that defy the old practice of dealing with customers as group members instead of as unique individuals. The focus shifts to adjusting solutions based on individual behaviors and personal requirements.

Myth #3: Personalization is a One-time Setup

The set-up procedure for personalization methods does not produce long-lasting results.

People often believe that installing personalization technology leads to self-operating systems. But customer behaviors change. The strategies that delivered success throughout last year have lost their effectiveness since the current day began. Personalization requires continuous maintenance to maintain its current effectiveness.

Myth #4: Personalization Compromises Privacy

The worry that banks are conducting intrusive monitoring of customer lifestyle habits exists among some users. The implementation of transparent systems, together with sturdy data security practices, enhances customer trust levels. Customers feel optimistic about personalized services after understanding data usage practices and maintaining full data control, leading them to embrace these services instead of rejecting them.

Challenges of Implementing Personalization

Financial institutions are currently experiencing a transformation in their customer relationship methods because of personalization. Customers want personalized banking services despite bank networks that struggle with fragmented information and data security fears and outdated operational methods.

So, what’s standing in the way? And more importantly, how can financial institutions overcome these barriers to deliver seamless personalization?

Let’s break it down.

1. The Problem with Data Silos

Banks have a wealth of customer data, but here’s the catch—it’s often trapped in different departments. Marketing, sales, and operations all collect their own data, but without a unified view, personalization efforts fall flat. Add legacy systems to the mix, making real-time insights even harder to achieve.

2. Privacy vs. Personalization: Finding the Right Balance

In 2023 alone, the average cost of a data breach reached $4.45 million, marking a 15% increase over the past three years. The European Union enforces strict data protection regulations, as seen in the €1.2 billion fine imposed on Meta by the Irish Data Protection Commission.

Financial institutions must walk a tightrope regarding personalization services under laws such as GDPR for the EU and CCPA for the U.S. to comply with regulations. The GDPR requires all businesses, including chatbots, to explain data collection purposes and storage periods to their users. At the same time, California residents protected by CCPA can seek full access to their stored information. The appropriate solution calls for both clear information disclosure and customer permission.

3. Outdated Systems Holding Back AI-Powered Personalization

Many banking institutions maintain core system infrastructure, which was never intended for real-time artificial intelligence-driven personalization features. The processing of big data quantities poses challenges for these systems because it creates obstacles for dynamic, personalized service delivery.

The way forward? Cloud-based AI solutions. Banks should incorporate flexible cloud platforms that support AI-based personalization functions instead of completely replacing their current systems. Banks can achieve better customer insight processing through modern platforms, enabling them to adjust their services dynamically to match evolving customer demands.

How Financial Institutions Use Personalization to Drive Revenue

The banking industry experiences revolutionary service changes through AI-powered tools and chatbots. Here’s how:

1. Customer Support: Enhancing Service Efficiency

From handling routine queries to streamlining banking operations, chatbots play a crucial role in customer service. These AI-driven assistants can process up to 80% of common inquiries, such as checking account balances, answering loan-related questions, and providing credit card details, ensuring speed and efficiency in customer interactions.

Take Bank of America’s Erica, for instance. This virtual assistant helps users manage transactions, pay bills, and access account summaries effortlessly. By combining real-time assistance with automation, Erica enhances customer experience, reduces wait times, and makes banking more accessible—all while improving operational efficiency for financial institutions.

2. Lead Generation: Turning Conversations into Conversions

Chatbots are more than just customer support tools—they also serve as powerful lead-generation engines. By engaging users in real time, AI-powered assistants can identify potential customers, provide personalized product recommendations, and capture essential contact details for follow-ups. Whether someone is exploring credit card options or searching for a high-yield savings account, chatbots simplify the decision-making process while ensuring a seamless user experience.

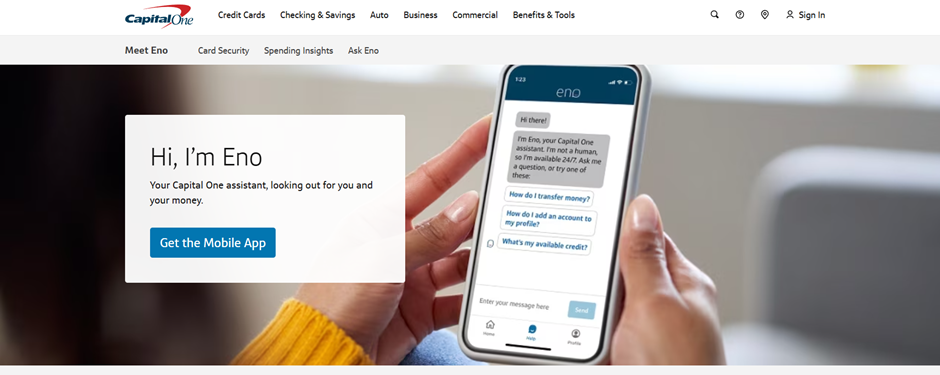

Capital One’s Eno is a great example. This virtual assistant helps customers track their spending, detect fraud, and introduce them to relevant financial products. Eno turns everyday interactions into meaningful conversions by combining proactive engagement with automation, benefiting both customers and banks.

3. Account Operations: Simplifying Everyday Transactions

Managing daily banking tasks has never been easier, thanks to AI-powered chatbots. From checking balances, downloading statements, authenticating transactions, and setting up new accounts, chatbots streamline operations, reducing reliance on manual processes and customer support teams.

Commonwealth Bank’s Ceba exemplifies this innovation. Capable of handling over 200 banking tasks, Ceba assists users with payments, balance inquiries, and even cardless cash transactions. By offering instant, secure, and hassle-free interactions, chatbots like Ceba redefine convenience in digital banking.

4. Omnichannel Personalization: A Seamless Banking Experience

Modern banking happens across multiple channels—mobile apps, websites, ATMs, and call centers. AI-powered chatbots ensure a seamless experience by maintaining consistency in personalization, delivering tailored offers, and sending timely notifications, regardless of the platform customers use.

A great example is Santander UK’s voice-assisted banking chatbot, which allows customers to check statements, report lost cards, and make payments using voice commands. By integrating AI-driven personalization across different touchpoints, banks can enhance convenience and create a more connected banking experience.

The Revenue Benefits of Personalization in Financial Services

AI-powered financial solutions and chatbots boost customer interactions and minimize client losses while achieving optimal operational spending to deliver customer-specific financial solutions. Let’s see the impact:

1. Higher Engagement & Lower Customer Churn

Personalized chatbot for financial services create environments where customers develop trust and exhibit higher loyalty. AI-based chatbots provide banks with real-time advice through personalized consultations, thus preventing customers from switching institutions.

Realizing this fact, JP Morgan allows users to complete necessary transactions through their chatbot, and Citi Singapore allows their customers to access banking data directly through Facebook Messenger.

Businesses using AI personalization achieve 70-90% automated customer support, enabling their human representatives to dedicate time to complex support requests, leading to better client retention rates.

2. Increased Cross-Selling & Up-Selling

Analyzing customer activities by AI-based chatbots enables them to suggest appropriate financial solutions. The data-based recommendation system enables better cross-selling and up-selling because customers who already use certain products tend to accept new items.

Implementing a chatbot system at Taxbuddy led to a dramatic rise of 13x for form fill-ups, thus boosting customer acquisition and engagement levels. Kommunicate’s AI-powered chatbot allowed the company to automate its digital platform tax filing support, freeing up 2,000 hours of work for their agents.

3. Optimized ROI for Marketing & Sales

AI-driven personalization enhances marketing efficiency. The most successful marketing tactic combines chatbots with customer interaction optimization to provide better data precision.

- Higher Conversion Rates: AITech chatbots optimize customer interactions for businesses, which leads to a $6.7 million cost reduction through automated call routing systems.

- Improved Sales Productivity: Organizational performance increases because automated lead qualification and contact verification tasks enable sales team members to concentrate on valuable prospects for better efficiency.

- Enhanced Data Quality: Chatbots powered by AI technology deliver correct data to marketers by reducing human mistakes in the information processing workflow.

4. Significant Cost Savings Through AI Automation

Through automation of important tasks, AI-driven chatbots significantly help to save banking costs. Using AI chatbots, BFSI organizations saved $23 million over three years, according to a Forrester research with cost cuts in:

- $13 million in customer complaint resolution.

- $6.7 million through automated call routing.

- $2.4 million in sales assistance via chatbots.

5. Higher Customer Lifetime Value (CLV)

Retaining a customer is less expensive than acquiring one. Deepening relationships, AI-driven personalization lowers turnover and, by up to five times, cuts acquisition costs. Chatbots also help authenticate consumer interactions and resolve dubious transactions, guaranteeing security and confidence and improving CLV.

Strategies for Achieving Personalization at Scale

Delivering personalization at scale is no longer optional—it’s a necessity.

Henry Ford once said:

“It is not the employer who pays the wages. Employers only handle the money. It is the customer who pays the wages.”

Customers expect their banks to understand their financial goals, anticipate their needs, and provide tailored solutions effortlessly. Achieving this requires a combination of AI, predictive analytics, and seamless data integration. Here’s how financial institutions can implement personalization effectively.

1. Creating a Unified Customer Profile with AI-Driven Insights

One of the biggest barriers to personalization is fragmented customer data across sales, marketing, and customer service. Without a complete view of each customer, financial institutions risk delivering disconnected experiences.

The solution? Customer Data Platforms (CDPs) that integrate real-time financial data, transaction history, and behavioral insights into a 360-degree customer profile. AI-driven analytics can then use this information to recommend personalized products, financial strategies, and proactive support.

2. Predictive Analytics for Proactive Financial Engagement

Customers don’t just want personalized recommendations—they expect their banks to anticipate their needs before they arise. Predictive analytics enables financial institutions to analyze patterns and forecast customer requirements.

For example, if a bank detects increased savings and real estate-related transactions, it can proactively suggest:

- Mortgage loan options tailored to the customer’s financial health

- Investment strategies for a future home purchase

- Home-buying educational content or financial planning tools

3. AI and the Need for Human Oversight

Personalization in banking receives fundamental change through artificial intelligence. A system handles tremendous amounts of information to predict individual needs and then generates customized solutions across various product ranges. Artificial intelligence presents restrictions because it cannot make human decisions, recognize emotional states, or interpret situations in their full reality.

Banks should consider the level of personalization they want to delegate to AI while determining the value of human involvement in this process. The solution exists in achieving optimum equilibrium. AI personalization functions optimally when bank personnel monitor its operations.

A combined organizational model allows AI systems to execute standard procedures but requires human intervention when dealing with complicated vital responsibilities. Through human supervision, banks can guarantee accurate personalization that respects industry standards, including PCI-DSS and GDPR.

Specific customer interactions must receive human intervention rather than machine processing. Human intervention ensures that financial and complaint handling and ethical decisions follow customer requirements and meet necessary regulatory conditions.

TelOne implemented the AI chatbot from Kommunicate to provide customer support services as part of their operations. TelOne improved staff work efficiency by 25% through their AI system, which automated standard customer service questions about mobile service resets and account technical assistance. The system shows that artificial intelligence delivers simple tasks that let employees handle complex financial demands.

4. Personalization from Onboarding to Retention

The customer journey starts the moment they engage with a financial institution. Ensuring a personalized onboarding experience lays the foundation for long-term engagement.

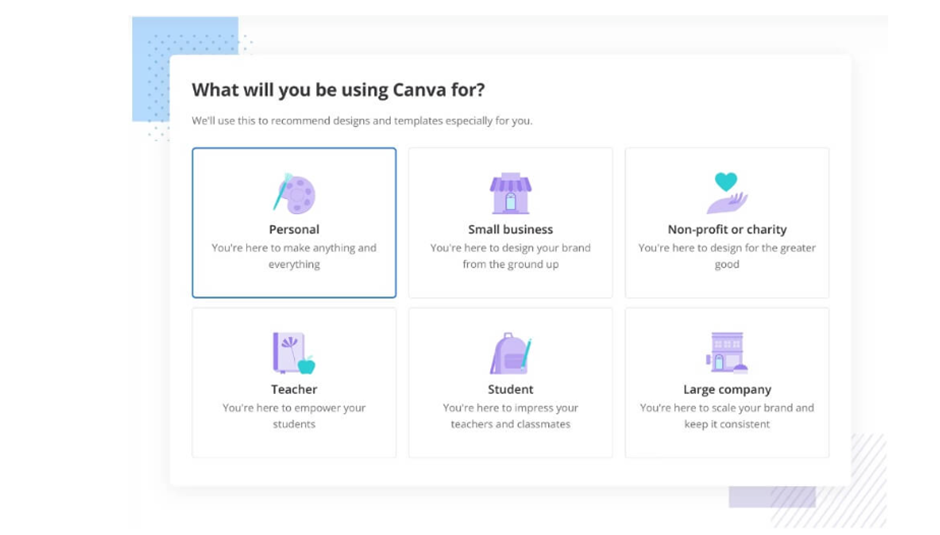

Let’s take a look at how banks can personalize customer experiences right from the start, much like digital platforms such as Canva.

When a new customer signs up, banks can ask key questions about their financial goals, such as saving for a home, investing, or managing daily expenses. Based on their responses, banks can segment customers into clear categories and provide tailored financial solutions that match their needs.

5. Omnichannel Personalization for Seamless Customer Experience

Customers interact with financial institutions across multiple platforms, like mobile apps, websites, ATMs, and social media. Banks need to integrate AI-driven personalization across all touchpoints to maintain consistent and personalized engagement.

For example, if customers explore investment options on a mobile app, they should receive personalized recommendations via email or chatbot without restarting their journey.

The Future of Personalization in Financial Services

Advancements in artificial intelligence (AI), new age, and new-generation technology are developing in a personalized chatbot for financial services. The innovations bring these changes to the industry through the following pathways:

1. Hyper-Personalization with AI

AI enables personalization to rise to unprecedented heights by analyzing massive amounts of real-time customer data to design individualized experiences. Financial institutions transform standard offers into specialized recommendations based on an individual’s spending habits, investment methods, and financial life goals. This level of hyper-personalization fosters customer trust, satisfaction, and long-term engagement.

2. Voice AI for Banking Personalization

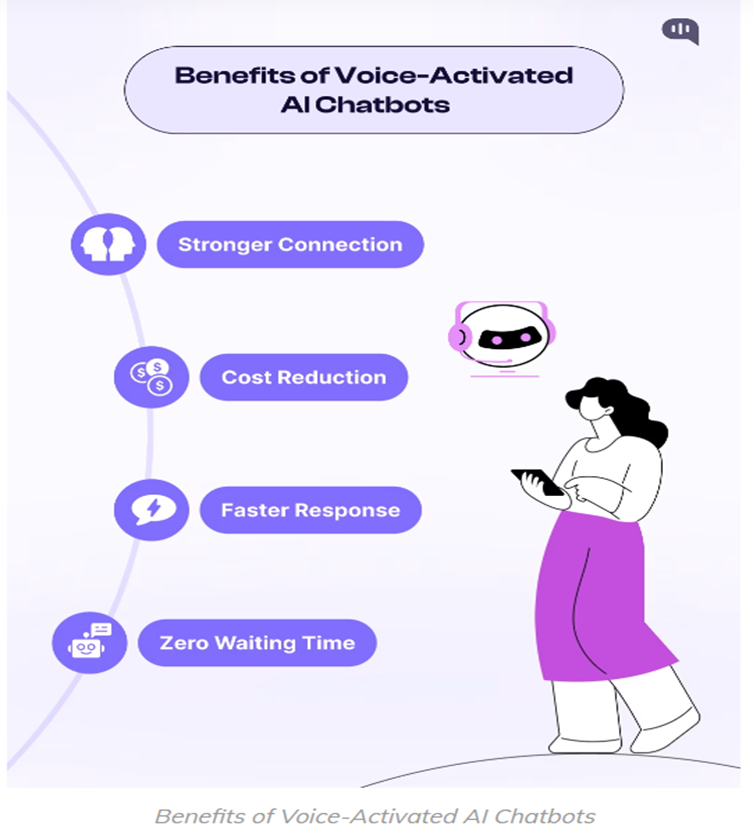

Voice-activated artificial intelligence significantly changes banking customer services by creating a more user-friendly platform to access chatbot for financial services. AI-driven financial voice assistants give users real-time remote access to manage their funds through a hands-free service.

Research shows that 70% of Gen Z customers prefer to use phone calls for their complex financial needs. Combining voice recognition technology improvements with natural language processing makes today’s voice chatbots faster and smarter while retaining greater contextual understanding abilities.

AI models using advanced technology analyze voice inputs simultaneously to separate noise from conversations while understanding contexts, which lets them provide immediate, relevant feedback. Service efficiency and customer engagement improvement occur along with reduced wait times. Financial institutions reduce operational costs while improving personalized banking services through this achievement.

3. Blockchain and Decentralized Finance (DeFi)

Combining AI and blockchain technology brings a groundbreaking period in customized chatbot for financial services. Financial platforms based on Decentralized Finance (DeFi) use Artificial Intelligence to evaluate decentralized financial information, which enables them to create customized financial solutions backed by blockchain technology that provides secure, transparent, and tamper-proof transaction capabilities.

4. Predicting Financial Needs Before They Arise

Predictive analytics moves personalization forward to become a proactive approach. Through AI-enabled financial systems, customers receive accurate predictions about their upcoming financial requirements by analyzing their behavior and daily visits.

Organizations can create loyal customers through their automatic predictive system by providing them with suitable solutions before their requests. For example, The AI system of a bank can notice rising customer savings and mortgage-related interest followed by automatic pre-approved home loan and financial planning service recommendations.

CEO & Co-Founder of Kommunicate, with 15+ years of experience in building exceptional AI and chat-based products. Believes the future is human + bot working together and complementing each other.