Updated on March 17, 2025

Insurance has always been a pain in the customer’s neck for a long time. Even with digitalization efforts, 46% of people still prefer talking to an agent over the phone to using a self-service option. This means there is a lot of potential for self-service tech, including chatbots.

AI-powered insurance chatbots are cutting-edge technology that may provide insurers with several advantages, including automated customer service available 24/7. These chatbots for insurance agents can instantly deliver quick responses, handle claims efficiently, and direct customers to relevant places for more information, enhancing customer engagement and reducing support costs.

Insurance companies looking to automate customer interactions and streamline insurance workflows are adopting HIPAA-compliant AI chatbots now more than ever. These AI-powered insurance chatbots help in customer service automation, reducing human intervention and ensuring seamless customer experiences.We will cover the various aspects of insurance processing and how chatbots can help.

Also, we will take a closer look at some of the most innovative insurance chatbots currently in use. Whether you are a customer or an insurance professional, this article will provide a comprehensive overview of the exciting world of insurance chatbots.

Table of Content:

- What is an Insurance Chatbot

- Top 4 Insurance chatbot use cases and examples

- 5 Popular Insurance Chatbots

- 6 Best Tools for Creating Insurance Chatbots

- Future of chatbots for insurance agents

- Conclusion

What Is an Insurance Chatbot?

An insurance chatbot is a virtual assistant powered by artificial intelligence (AI) that is meant to meet the demands of insurance consumers at every step of their journey. Insurance chatbots are changing the way companies attract, engage, and service their clients.

Conversational AI chatbots for insurance have gained immense popularity in the insurance industry. Around 71% of insurance executives predicted that AI-powered insurance chatbots would soon replace human representatives, providing instant customer service automation and enhancing policyholder experience.

Chatbots provide round-the-clock customer support, the automation of mundane and repetitive jobs, and the use of different messaging platforms for communication. Some of the best use cases and examples of chatbots for insurance agents are as mentioned below. For an easier understanding, we have bucketed the use case based upon the type of service that the chatbots can provide on behalf of insurance agents.

Top 4 Insurance Chatbot Use Cases and Examples

For example, after releasing its chatbot, Metromile, an American vehicle insurance business, accepted 70-80 percent of chatbot insurance claims almost promptly.

1. Issuing Policies

Conventionally insurance agents used to make house calls or even reach out digitally to explain the policy features. Customers would then make a decision on what would suit their needs best. Here is how insurance chatbots can help in this regard.

a. Customized Quotes for New Customers

Chatbots can gather information about a potential customer’s financial status, properties, vehicles, health, and other relevant data to provide personalized quotes and insurance advice. They can also give potential customers a general overview of the insurance options that meet their needs.

b. Responding to Policyholder Questions

Chatbots can offer policyholders 24/7 access to instant information about their coverage, including the areas and countries covered, deductibles, and premiums.

Cross-Selling and Upselling

By utilizing machine learning to predict which insurance policies a customer is most likely to purchase, chatbots can use recommendation systems to identify upselling and cross-selling opportunities. Based on the data and insights gathered about the customer, the chatbot can make relevant insurance product recommendations during the conversation.

You might also want to read Sales Chatbots: How to Grow 10x Revenue Using Chatbots

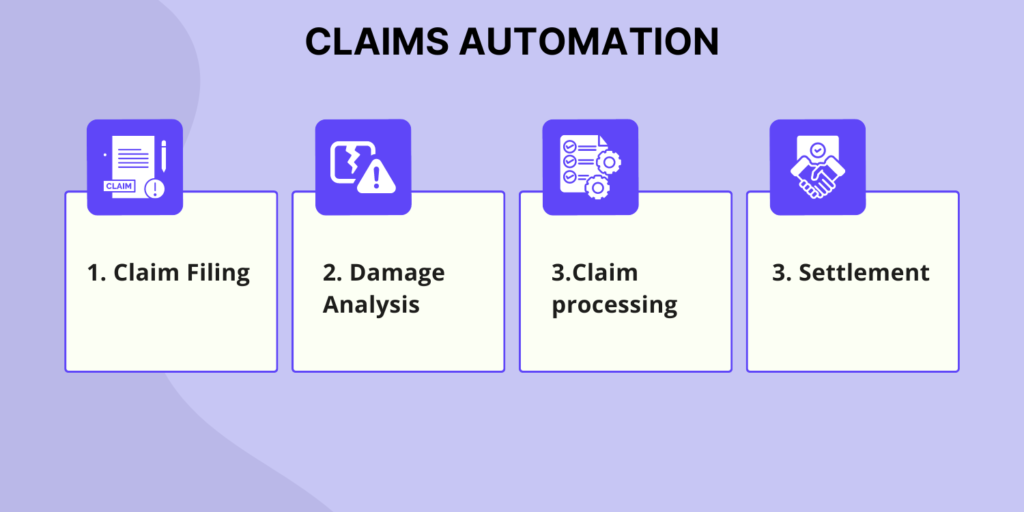

2. Claims Automation

AI-powered claims processing is a game-changer in the insurance sector. Traditional claims processing involves manual tasks, delays, and human errors, but insurance chatbots for claim automation streamline the entire process. Using AI-driven customer service automation, insurers can reduce turnaround times, minimize errors, and offer instant claim updates.

a. Claim Filing

Submitting a claim, known as the First Notice of Loss (FNOL), requires the policyholder to complete a form and provide supporting documents. This can be made easier by using a chatbot that engages in a conversation with the policyholder, collecting the necessary information and requesting documents to streamline the claim filing process.

b. Damage Analysis

The necessity for physical and eligibility verification varies depending on the type of insurance and the insured property or entity. A chatbot can assist in this process by asking the policyholder to provide pictures or videos of any damage (such as from a car accident). The bot can either send the information to a human agent for inspection or utilize AI/ML image recognition technology to assess the damage. Next, the chatbot will determine responsibilities based on the situation.

Claim Processing

Once the assessment and evaluation of the damage are finished, the chatbot can communicate the amount of reimbursement that will be transferred by the insurance company to the TPA and finally to the policyholder.

d. Settlement

The next part of the process is the settlement where, the policyholder receives payment from the insurance company. The chatbot can keep the client informed of account updates, payment amounts, and payment dates proactively. For instance, Metromile, an American car insurance provider, utilized a chatbot named AVA chatbot for processing and verifying claims. AVA approved a remarkable 70-80% of claims immediately.

Insurance carriers can use chatbots to handle broker relationships in addition to customer-facing chatbots. Furthermore, chatbots can respond to questions, especially if they deal with complex client requests. This also applies when you need to know how an application is progressing.

Bonus read: How Customer Service Chatbots Can Improve The Customer Experience

3. Fraud Detection

Many times, it so happens that people are lured and trapped by sales agents, which ultimately leads to fraud. Chatbots are enabled by artificial intelligence that eliminates most probabilities of fraud.

Moreover, chatbots may also detect suspected fraud, probe the client for further proof or paperwork, and escalate the situation to the appropriate management. For providers, fraud protection may save them a lot of money.

Feedback on Services

Chatbots facilitate the efficient collection of feedback through the chat interface. This can be done by presenting button options or requesting that the customer provide feedback on their experience at the end of the chat session.

Additionally, a chatbot can automatically send a survey via email or within the chat box after the conversation has concluded.

5 Popular Insurance Chatbots

If we are to analyze how insurance chatbots are transforming the insurance sector, we would need to go through real-life implementation. Some of these use cases can help you decide what chatbot would suit your business the best:

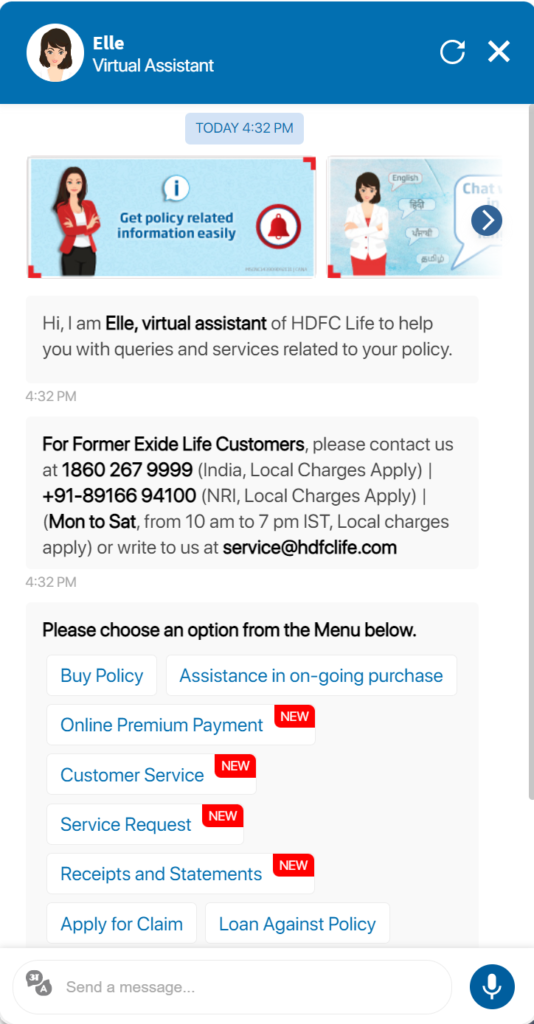

1. HDFC Life Insurance’s Elle Virtual Assitant

Obtaining life insurance can be a tedious task, and customers might have a lot of queries to even begin with.

HDFC Life Insurance realized the challenges in insurance and came to Kommunicate for an automated support solution. That’s how Elle, the Virtual Assistant, was created to handle inbound customer queries and service.

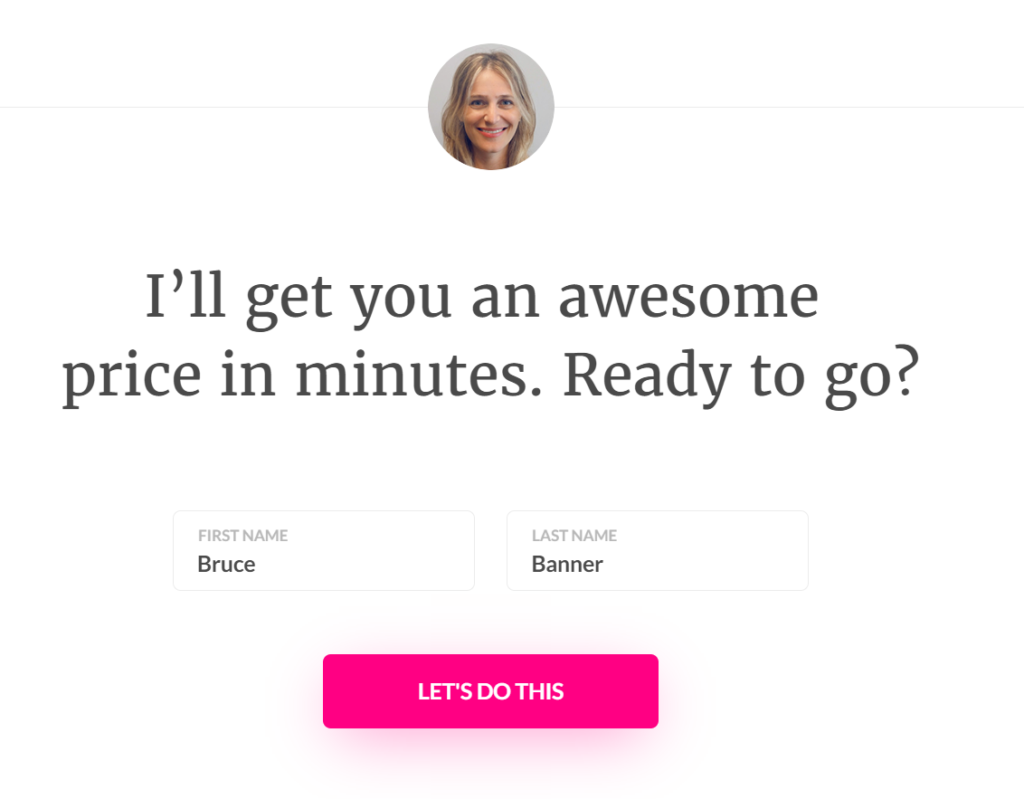

2. Lemonade’s Engaging Sales Funnel Experience

Lemonade’s chatbot, Maya, brings a personalized touch to the insurance experience. With a warm, friendly voice and a smiling avatar that aligns with Lemonade’s brand, Maya engages users in a conversational and welcoming manner. Her name, Maya, also adds a friendly and feminine feel to the chatbot.

Maya assists users in completing the forms necessary for obtaining a quote for an insurance policy. Such forms provide opportunities for upselling. This chatbot is a prime example of how to efficiently guide users through the sales funnel engagingly and effectively.

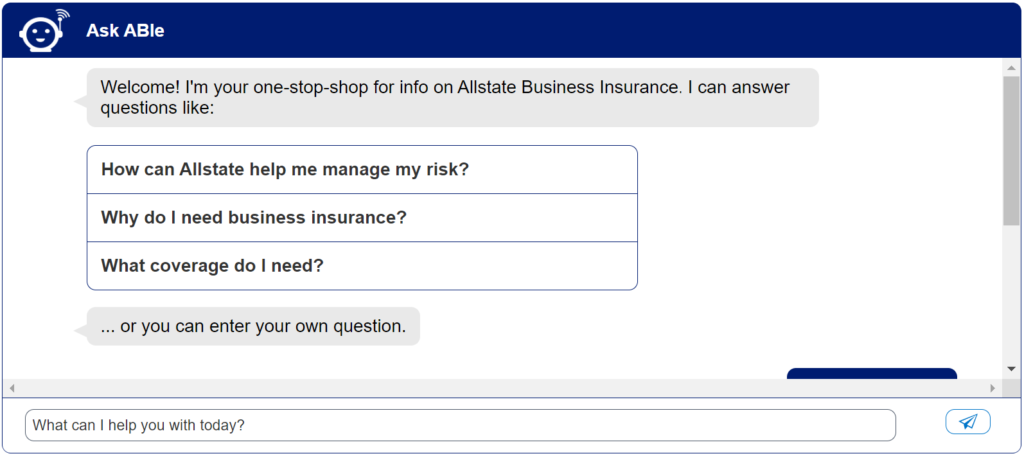

3. Allstate Business Insurance Chatbot (ABIE)

Allstate Business Insurance utilizes a chatbot known as the Allstate Business Insurance Expert (ABIE). According to the company, this chatbot can assist small business owners by providing answers to basic questions like “What is a deductible?” and “How does the insurance claims process work?”

Furthermore, the company claims that the chatbot can enhance the relationship between the agent and the customer through natural language processing.

4. GEICO’s Virtual Assistant Kate

GEICO offers a chatbot named Kate, which they assert can help customers receive precise answers to their insurance inquiries through the use of natural language processing. GEICO states that customers can communicate with Kate through the GEICO mobile app using either text or voice.

The chatbot provides answers to insurance-related questions and can direct users to the relevant GEICO mobile app section if necessary. For instance, if a customer is seeking roadside assistance and is unable to find the relevant menu within the app, Kate will guide the user to the appropriate menu.

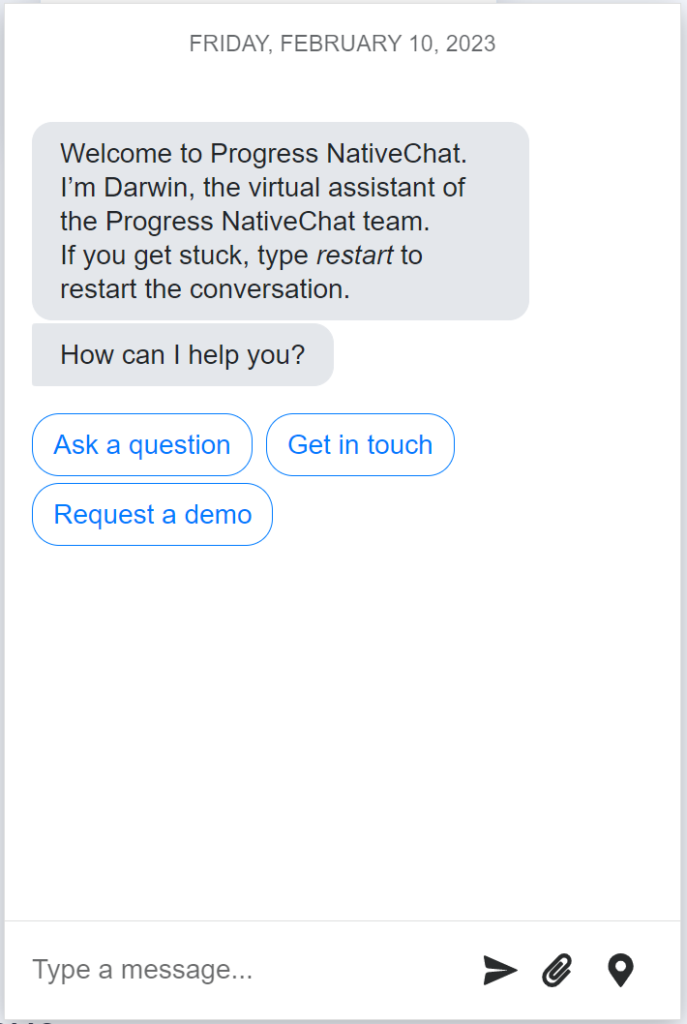

5. Native Chat from Progress

Progress has developed software named Native Chat, which the company asserts can reduce customer service expenses. Furthermore, it accelerates marketing efforts for insurance companies. The system leverages natural language processing and has likely been trained on numerous customer service questions. Such questions are related to basic insurance topics such as billing and modifying account information.

According to Progress, insurance companies can implement Native Chat to create chatbots for their company smartphone apps, allowing customers to communicate with the chatbot after downloading the app.

Chatbots will also use technological improvements, such as blockchain, for authentication and payments. They also interface with IoT sensors to better understand consumers’ coverage needs. These improvements will create new insurance product categories, customized pricing, and real-time service delivery, vastly enhancing the consumer experience.

As brokers, customers, carriers, and suppliers focus on higher productivity. They also focus on lower costs, and improved customer experience, the rate of change will only accelerate.

The ability of chatbots to interact and engage in human-like ways will directly impact income. The chatbot frontier will only grow, and businesses that use AI-driven consumer data for chatbot service will thrive for a long time.

6 Best Tools for Creating Insurance Chatbots

Creating insurance chatbots can be an effective way to streamline customer support and enhance the overall user experience. Here are 6 popular tools for building insurance chatbots:

1. Kommunicate: Kommunicate is a customer support and messaging platform that enables businesses to engage with their customers across various channels. It provides tools and features to facilitate real-time conversations, automate responses, and manage customer interactions effectively. Kommunicate supports both live chat and chatbot capabilities, allowing businesses to provide instant assistance to customers and automate responses to common queries.

2. Dialogflow: Developed by Google, Dialogflow is a powerful natural language understanding platform. It enables you to design conversational agents that understand user intents and provide relevant responses. Dialogflow supports integration with various messaging platforms, making it suitable for building insurance chatbots that can engage with customers across different channels.

3. IBM Watson Assistant: IBM Watson Assistant is an AI-powered chatbot platform that offers advanced features for creating sophisticated conversational agents. With Watson Assistant, you can build insurance chatbots capable of handling complex customer queries and providing personalized recommendations. It also provides tools for training the chatbot using historical data to improve its performance.

4. Microsoft Bot Framework: Microsoft Bot Framework is a comprehensive platform for developing intelligent bots. It offers a range of tools and services for building, testing, and deploying chatbots across multiple channels. With its natural language processing capabilities, you can create insurance chatbots that understand user inputs and deliver accurate responses. It also provides integration with Microsoft Azure for scalability and deployment flexibility.

5. Chatfuel: Chatfuel is a user-friendly chatbot development platform that doesn’t require coding skills. It offers a drag-and-drop interface, making it easy to design and customize conversational flows. Chatfuel provides various templates and plugins specifically designed for building insurance chatbots. It supports integration with popular messaging platforms like Facebook Messenger and allows seamless interaction with customers.

Boost support efficiency and resolve queries faster with

AI-powered email ticketing from Kommunicate!Future of Chatbots for Insurance Agents

Insurance is a tough market, but chatbots are increasingly appearing in various industries that can manage various interactions. These interactions include aiding with travel plans and end-to-end booking or utilizing medical records for planned visits and prescription delivery. Chatbots will transform many industry sectors as they evolve, shifting the process from reactive to proactive.

The position of insurance agents will also alter substantially. Agents will move from being mere mediator to an advisor. Agents will focus on providing relevant coverage and assisting consumers with portfolio management. Such focus is due to the use of intelligent personal assistants to streamline processes and AI-enabled bots to uncover new offers for customers. They’ll make customer contacts more meaningful by shortening them and tailoring each one to the client’s present and future demands.

Conclusion

To compete in today’s insurance market, carriers must first and foremost focus on their clients’ changing expectations–expectations that are frequently influenced by factors outside of the insurance industry. Agents may utilize insurance chatbots as another creative tool to satisfy consumer expectations and provide the service they have grown to expect.

How many insurance companies use chatbots?

According to a 2019 Statista poll, 44% of clients are comfortable using chatbots insurance claims, while 43% are happy to purchase insurance coverage. As a result, practically every firm has embraced or is using chatbots to take advantage of the numerous benefits that come with them.

——————————————————————————————————————————-

At Kommunicate, we are envisioning a world-beating customer support solution to empower the new era of customer support. We would love to have you on board to have a first-hand experience of Kommunicate. You can signup here and start delighting your customers right away.

Naveen is an accomplished senior content writer with a flair for crafting compelling and engaging content. With over 8 years of experience in the field, he has honed his skills in creating high-quality content across various industries and platforms.